Obama’s Plan to Tax the Rich: Totally Worthless, Sophomoric, and Cynical

Warren Buffett explained the secret to addressing the challenges facing the United States during President Obama’s first term. In a short commentary written for The New York Times—headline: “Stop Coddling the Super-Rich”—Buffett explained, “My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice.”

President Obama was relatively cautious about taking Buffett’s advice.

Until now.

With an eye toward addressing income inequality, the president will use his State of the Union Address to propose new taxes and fees on very rich people and very big banks. In any historical context, the tax hikes and fees are “modest,” but after a period of absurd austerity and slow-growth economics, Obama’s move is as important as it is necessary.

At a point when there is broadening recognition of the social and economic perils posed by income inequaliy, the president is talking about taking simple steps in the right direction. Congress is unlikely go along with him, but the American people will—Gallup polling finds that 67 percent of likely voters are dissatified with income and wealth distrution in the United States. And as this country prepares for the critical presidential and congressional elections of 2016, the president’s clarifying of the terms of debate on taxes becomes vital.

What utter nonsense. You can’t get out of our deficit problems by taxing the rich. As I said in 2011:

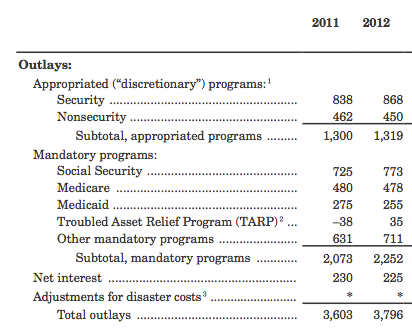

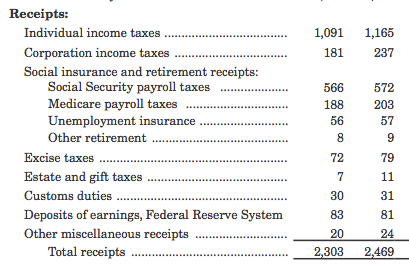

[O]ne of the points I have been making lately is that higher taxes on the rich cannot possibly balance the budget no matter how confiscatory they are. You could return to 2000 levels for incomes over $200,000, raise the top rate to 50% for those making $500,000, 60% for those making over $5 million, and a sky-high 70% for those making over $10 million, and you know what you would raise? An extra $133 billion per year, in a budget whose deficits are more than 10 times that amount.

I have also made the point that increases in taxes, even giant ones, don’t do much to increase revenue:

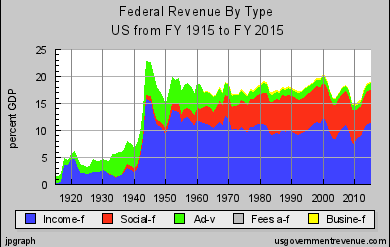

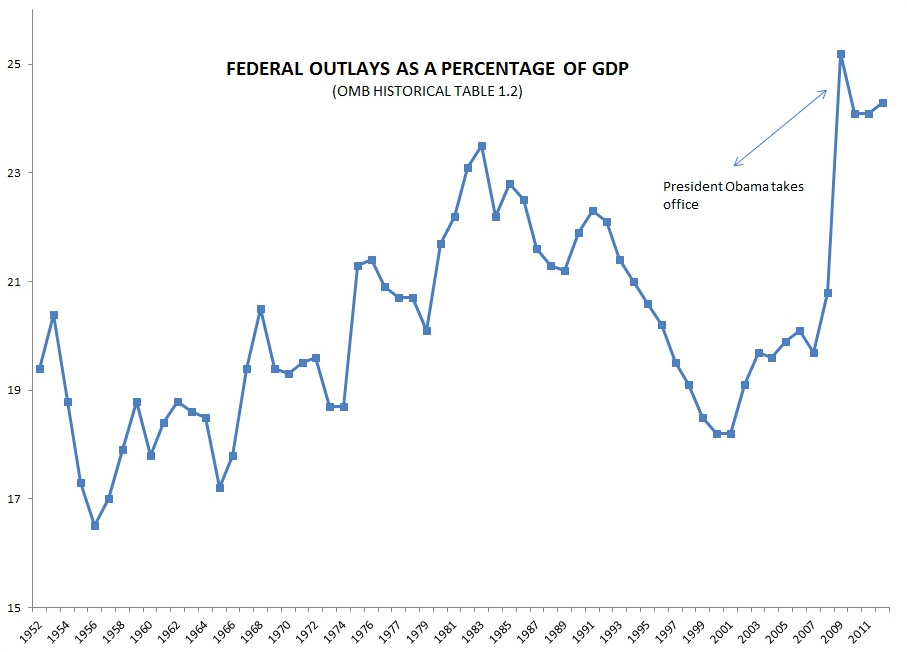

[W]hether the top tax rate is 90% as it was in 1960, or 30-40% as it’s been since 1990, federal revenue is always 15-20% of GDP:

The whole “income inequality” canard has been addressed here before. Our Savior Mitt Romney thinks its a problem, as I noted here. But it’s not. The free market is the best thing that ever happened to poor people, which is in large part a testament to the consumer surplus. Interfere with the workings of the free market, and you approach communism: that wonderful state where everyone is the same, namely, equally poor. (In actuality, not everyone is the same; party members get special treatment and black markets flourish. But never mind all that!) As Margaret Thatcher said (and I noted in this post): “What the honorable member is saying, is that he would rather the poor were poorer, provided the rich were less rich. . . . Yes, he would rather have the poor poorer, provided the rich were less rich.”

That’s what Obama wants. Never mind that the free market is the best thing in the world for poor people. He wants to end it, and he’ll bend the rules to do so.

P.S. I’ve been reading lately about the fall of the Roman Republic, and it seems eerily reminiscent of Obama’s actions lately. But that’s another post.

We can’t get rid of this guy quick enough.

UPDATE: Since some people don’t get it yet, let me quote this post of mine from 2013 (already linked above):

First, even confiscating all millionaires’ taxable income would not close the gap. It’s difficult to find recent statistics for these numbers, but in posts I wrote in April 2011 I quoted people who had examined IRS statistics and found that in 2008, “Taxable income over $100,000 was $1,582 billion, over $200,000 was $1,185 billion, over $500,000 was $820 billion, over $1 million was $616 billion, over $2 million was $460 billion, over $5 million was $302 billion, and over $10 million was $212 billion.” To get that $1.3 trillion you can’t close the gap by taxing rich people. You could confiscate all the income of people with taxable income over $1 million and it would not close the gap by half.

Of course, that assumes that people with a 100% tax rate would happily continue to work just as hard as they had when they got to keep some of their money. If you believe that, you’re an idiot.