Remember When Hillary Clinton Said, “I’m confident that this process will prove that I never sent, nor received, any email that was marked classified”??

[guest post by Dana]

Well, so much for her confidence because this is the scandal that just keeps on giving:

The State Department has deemed roughly 150 more of Hillary Clinton’s email messages to be classified, a move certain to fuel the roiling controversy over her use of a private email server instead of an official government account when she served as secretary of state.

The new classifications will more than triple the previous total of 63 classified messages on Clinton’s account, but State Department spokesman Mark Toner stressed that the information was not marked classified at the time it was sent several years ago. He also said the decisions to classify the information did not represent a determination that it should have been marked or handled that way back then.

“That certainly does not speak to whether it was classified at the time it was sent, or forwarded, or received,” Toner said during the daily State Department briefing on Monday. “We stand by our contention that the information we’ve upgraded was not marked classified at the time it was sent.”

And more defense:

Toner batted away questions about whether State Department policy dictated that Clinton and other agency employees treat as classified information obtained in confidence from foreign officials or diplomats.

“Classification — we’ve said this many times — is not an exact science. It’s not, often, a black-and-white process,” Toner said. “There’s many strong opinions. … It’s not up to me to litigate these kinds of questions from the State Department podium.”

All of this comes in advance of the State Department’s pending release of 7,000 “additional pages” of her emails.

Also, not only did Clinton use a private server for official State Dept. business, a new report asserts that she also shared an email network with the Clinton Foundation:

Records reveal that Hillary Clinton’s private clintonemail.com server shared an IP address with her husband Bill Clinton’s email server, presidentclinton.com, and both servers were housed in New York City, not in the basement of the Clintons’ Chappaqua, New York home.

Web archives show that the Presidentclinton.com Web address was being operated by the Clinton Foundation as of 2009, when Hillary Clinton registered her own clintonemail.com server.

Numerous Clinton Foundation employees used the presidentclinton.com server for their own email addresses, which means that they were using email accounts that, if hacked, would have given any hacker complete access to Hillary Clinton’s State Department emails, as well.

The bombshell revelation raises new concerns about the possible illegality of Hillary Clinton’s private email use. The former Secretary of State is under federal investigation for potentially violating the Espionage Act by allowing people without a security clearance to access classified information. The fact that Hillary was sharing an email network with a private foundation means that people without a security clearance almost certainly had physical access to her server while she was working at the State Department.

As a reminder, this was Hillary back in March, 2015:

“Well the system we used was set up for President Clintons office and it had numerous safeguards it was on property guarded by the Secret Service and there were no security breaches, so I think that the use of that server which started with my husband proved to be effective and secure,” Hillary Clinton said in a March 2015 press conference.

But hey, don’t make a big deal about her email issues, it’s all good:

The New York Times @nytimes Aug 26

Hillary Clinton takes responsibility for email use, saying it “wasn’t the best choice” http://nyti.ms/1EjMxdN

What do you think it will take for her to suspend her campaign?

(I’m thinking nothing short of being escorted away in handcuffs…)

–Dana

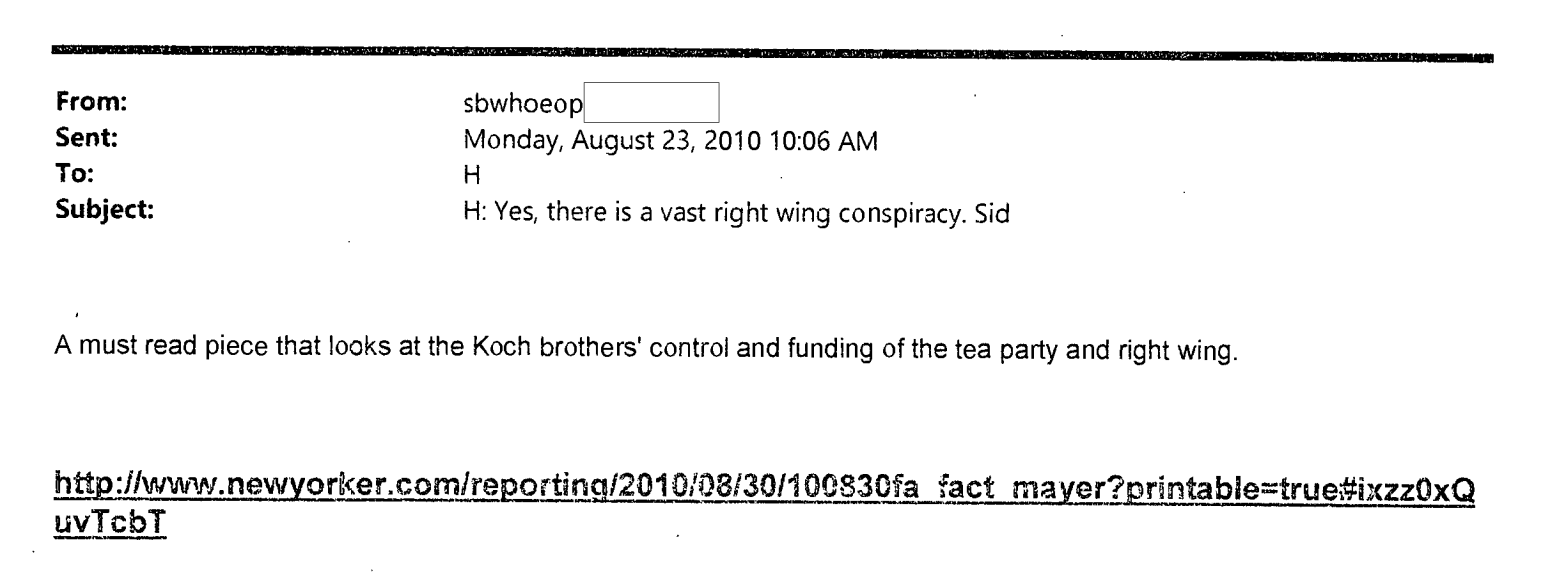

UPDATE BY PATTERICO: Yes, there is a vast right-wing conspiracy!

UPDATE BY PATTERICO x2:

Sid B.: "the hysterical tone of much of the Israeli leadership and US Jewish community." HRod: "pls print 3 copies." pic.twitter.com/H8o9vfGEKk

— Patterico (@Patterico) September 1, 2015