The IRS’s targeting of conservative groups has at least one unabashed fan: Michael Hiltzik of the Los Angeles Times. As evidence mounts that the IRS fast-tracked applications by left-leaning organizations while erecting burdensome obstacles for conservatives, Hiltzik cheers from the sidelines, praising the IRS and placing the word “scandal” in scare quotes:

It’s strange how “scandal” gets defined these days in Washington. At the moment, everyone is screaming about the “scandal” of the Internal Revenue Service scrutinizing conservative nonprofits before granting them tax-exempt status.

Here are the genuine scandals in this affair: Political organizations are being allowed to masquerade as charities to avoid taxes and keep their donors secret, and the IRS has allowed them to do this for years.

. . .

It’s about time the IRS subjected all of these outfits to scrutiny. The agency’s inaction has served the purposes of donors and political organizations on both sides of the aisle, and contributed to the explosive infection of the electoral process by big money from individuals and corporations.

The problem, as Hiltzik well knows (but almost entirely ignores), is that the IRS did not treat “both sides of the aisle” equally. A USA Today story describes how, just before the new anti-Tea Party policy went into effect, an Illinois Tea Party organization had its application speedily approved. But, the story goes on to explain:

That was the month before the Internal Revenue Service started singling out Tea Party groups for special treatment. There wouldn’t be another Tea Party application approved for 27 months.

In that time, the IRS approved perhaps dozens of applications from similar liberal and progressive groups, a USA TODAY review of IRS data shows.

As applications from conservative groups sat in limbo, groups with liberal-sounding names had their applications approved in as little as nine months.

. . . .

Like the Tea Party groups, the liberal groups sought recognition as social welfare groups under Section 501(c)(4) of the tax code, based on activities like “citizen participation” or “voter education and registration.”

The Inspector General’s report is now available, and it confirms USA Today‘s conclusion that the IRS’s criteria do not appear to have been impartial:

[T]he criteria developed by the Determinations Unit gives the appearance that the IRS is not impartial in conducting its mission. The criteria focused narrowly on the names and policy positions of organizations instead of tax-exempt laws and Treasury Regulations.

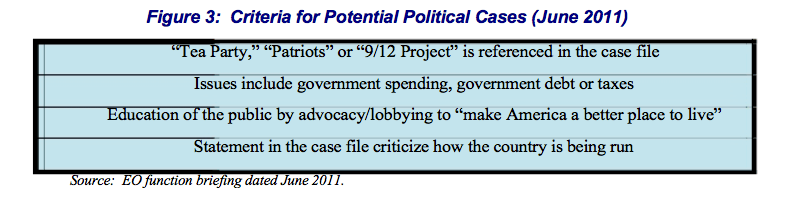

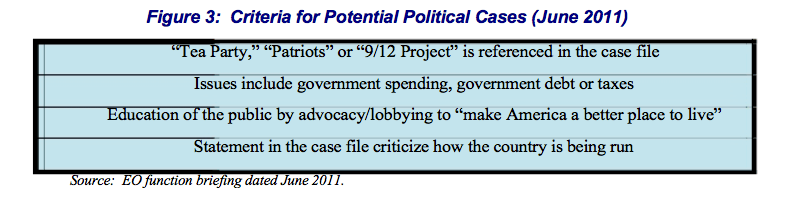

The report has a chart that shows criteria in June 2011 for increased scrutiny:

The harshest criticism Hiltzik can muster for these one-sided criteria is that they provide “too coarse a screen.” He does not seem at all troubled by the fact that the only names singled out for extra scrutiny were names associated with conservative principles such as limited government and lower taxes. In fact, he implies — without a scrap of evidence and in contradiction to the IG report and virtually every extant news article to have examined the subject — that the criteria were even-handed and that we are hearing only about the extra burdens placed on one side.

The bottom line is that we live in an America where 501(c)’s run by, say, convicted bomber and leftist serial partisan harasser Brett Kimberlin are put on the fast track, whereas 501(c)’s that are concerned with the expansion of government are delayed to the point of absurdity. And Michael Hiltzik thinks that is just peachy.

Hiltzik is not a stupid man, just a dishonest one. He knows full well that the problem with the IRS’s actions is the disparate treatment given conservatives and leftists. If you want absolute proof that Hiltzik’s views are partisan hackery as opposed to a genuine concern over dirty money in politics, you need only read this passage:

[O]nce again, now that the agency has tried to regulate, the regulated parties have blown its efforts up into a “scandal.” It’s amusing to reflect that some politicians making hay over this are the same people who contend that we don’t need more regulations, we just need to enforce the ones we have. (Examples: gun control and banking regulation.) Here’s a case where the IRS is trying to enforce regulations that Congress enacted, and it’s still somehow doing the wrong thing.

Keep that in mind when you hear politicians — and they’re not exclusively Republicans — grandstanding about how the IRS actions are “chilling” or “un-American.” It turns out that none of the “targeted” groups actually was denied C4 status.

Oh! Well, if they weren’t denied C4 status, then all is well!

Except that, as the IG report details:

[T]he applications for those organizations that were identified for processing by the team of specialists experienced significant delays and requests for unnecessary information.

And again, these delays and burdensome and unnecessary requests fell primarily (if not exclusively) on one side of the aisle, and caused many conservatives to give up on obtaining tax-exempt status for their group.

Apparently Michael Hiltzik thinks that it would be OK to have a four-hour line for Republicans at the DMV, while “progressives” speed through an express line. Hey, no Republicans were denied licenses, were they?

We probably should apply greater scrutiny to tax-exempt organizations generally. I’d be fine with abolishing such organizations entirely. Indeed, the fact that taxpayers subsidize political activity is what gives government the power to favor one side over another.

But any extra scrutiny needs to be even-handed, and that is the problem that Hiltzik deliberately overlooks.

Memo to Hiltzik: the IRS itself has apologized and said that their targeting of conservatives was inappropriate. How much of a hack do you have to be to defend them after they admitted what they did was wrong?

Boy, it sure would be awful if the Koch brothers bought the L.A. Times and folks like Michael Hiltzik quit in a huff. How could we survive without utter partisan nonsense like this in the pages of our hometown newspaper?