The Budget Numbers That People on the Left Don’t Seem to Understand

Every so often I get into a discussion with someone on the left about the budget, and I find time and again that they seem to think that Social Security and Medicare are not such a big problem — or that the problem they pose can be easily fixed through a small tax increase.

I attempted to address that issue in this post, which embedded this very helpful video:

But I should know by now that, just like readers often don’t click the links, they don’t always watch the videos either.

So I’m going to take the key facts and bring them to the fore, in print, so I will have a post I can refer back to in the future when this issue comes up.

What I am about to post is fairly dense but I think I have made it clear. The bottom line is that, just to balance the budget in 2012, we would have had to raise taxes on everyone 50%. You can’t do it by taxing the rich only, either, because historically even 90% rates don’t bring in more than 18% of GDP, and we are spending 24-25% of GDP. Even if rich people didn’t modify their behavior, there isn’t enough taxable income from the rich to close the gap.

Here are the details:

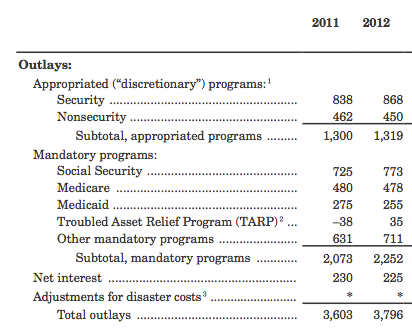

This is from the President’s 2013 budget, downloadable as a 4.6 MB .pdf here. At page 210, you have the following outlays:

As you can see, what we call “discretionary programs” was $1.3 trillion in 2012. This is basically the entire federal government: Defense, Education, State, Justice, and so forth.

Then we have what we call “non-discretionary programs,” which are Social Security (including SSI), Medicare, Medicaid, unemployment insurance, and TARP (which is comparatively very small). That totaled $2.25 trillion in 2012.

Interest on all this was $225 billion. Add it all up and the total outlays are a hair shy of $3.8 trillion.

Got that?

Discretionary = $1.3T

Nondiscretionary = $2.25T

Interest = 225B

Total = $3.8T

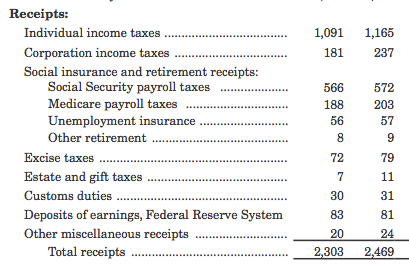

Now for what we take in:

2012 is again the right-most column. As you can see, that’s $1.16 trillion in individual income taxes and $237 billion in corporate income taxes, for a total of $1.4 trillion in income taxes. Payroll taxes (Social Security and Medicare) plus other social insurance taxes total $841 billion. We get about another $235 billion in excise taxes, estate and gift taxes, customs, and related taxes. Our total receipts were $2.47 trillion. Let’s put that in a table like above:

Income tax: $1.4T

Payroll tax: $841B

Other tax: $235B

Total: $2.47T

We’re $1.3 trillion short.

Now, here’s the problem. Pretend we didn’t even have the federal government. In other words, pretend we had no military, no Department of Justice, no Department of Health and Human Services, etc. You eliminate the entire federal government, and just pay nondiscretionary programs and interest. (There would be no employees to issue the checks, but it’s a thought experiment.) You would have to pay $2.5 trillion. But our total revenues are less than that, at $2.47 trillion.

So you use up all our tax revenue, and you still haven’t quite paid entitlements. After you deal with entitlements, every cent of discretionary spending is now borrowed.

To make up the gap by taxing people, in 2012 you would have needed another $1.3T on top of the $2.47T we already took in. That means taxes would have to be raised 50%, across the board. Payroll tax, income tax, everything. If you paid $20,000 in 2012, you’d have to pay $30,000 to sustain Social Security and Medicare.

Can’t we just tax the rich? No, for two reasons.

First, even confiscating all millionaires’ taxable income would not close the gap. It’s difficult to find recent statistics for these numbers, but in posts I wrote in April 2011 I quoted people who had examined IRS statistics and found that in 2008, “Taxable income over $100,000 was $1,582 billion, over $200,000 was $1,185 billion, over $500,000 was $820 billion, over $1 million was $616 billion, over $2 million was $460 billion, over $5 million was $302 billion, and over $10 million was $212 billion.” To get that $1.3 trillion you can’t close the gap by taxing rich people. You could confiscate all the income of people with taxable income over $1 million and it would not close the gap by half.

But there’s another problem: it wouldn’t work that well anyway. As I illustrated yesterday, we have had top marginal rates as high as 91% and as low as 28%, and we still get about 18% of GDP in revenues every year, regardless. Extremely rich people change their behavior when you start to confiscate all their money.

We haven’t even addressed paying off almost $17 trillion in debt. Nor have we addressed the widening gap between revenues and entitlement payouts caused by the aging of the workforce. All we have discussed is what to do to close the gap in a single year: 2012.

Without reforming entitlements, it is simply impossible.

Which means we’ll keep coasting, adding over $1 trillion to the debt every year, until it all comes crashing down.

The Democrats I talk to don’t understand this. But you can’t be president and not understand this.

Barack Obama is lying to the American people when he says we don’t need to fundamentally reform entitlements.