L.A. Times: Californians Favor Having Other People Pay for Their Free Stuff

The L.A. Times says people in California like Obama’s proposal of raising taxes on other people:

“People are in favor of compromise as long as other people are doing the compromising,” said David Kanevsky of the Republican firm American Viewpoint, half of a bipartisan duo that conducted the poll for The Times and the USC Dornsife College of Letters, Arts and Sciences.

The poll also confirmed the outcome of last week’s election, in which President Obama won a second romping victory in California. There was broad support for the president and his campaign proposal to raise taxes on incomes over $250,000 a year.

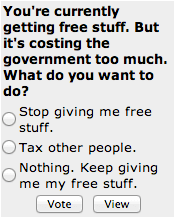

Sure. When you’re getting free stuff, you want to keep getting free stuff. If someone says it’s not getting paid for, the first reaction is: tax someone else. Which do you figure Californians would choose from this set of options:

Just one little problem: taxing other people is not going to solve anything. It’s time for another edition of Now That the Election Is Over, It’s Safe to Tell the Truth. But make sure and blame the previous suppression of this truth on the candidates:

“You have to feel bad for voters,” said poll director Dan Schnur of the Jesse M. Unruh School of Politics at USC. “After a yearlong presidential campaign, no one has bothered to tell them that raising taxes on people making over $250,000 does not balance the federal budget. No one on either side.

“Obama said the wealthy should pay their fair share. Romney said it would kill jobs. But neither one of them told voters that balancing the budget is a lot tougher than that.”

Well. Maybe Romney didn’t say it, or didn’t say it memorably enough that Dan Schnur remembers it. (I’d be willing to bet he did.) But for Schnur to say, and the L.A. Times to repeat, that “no one on ether side” said this, is flatly untrue. Witness:

Look, if you taxed every person in successful small business making over $250,000 at a hundred percent, it’d only run the government for 98 days. If everybody who paid income taxes last year, including successful small businesses, doubled their income taxes this year, we’d still have a $300 billion deficit.

You see, there aren’t enough rich people and small businesses to tax to pay for all their spending. And so the next time you hear them say, don’t worry about it, we’ll get a few wealthy people to pay their fair share, watch out, middle class. The tax bill is coming to you.

Who said it? That’s right: Paul Ryan, in arguably the biggest platform he had: the Vice Presidential debate.

Remember how Big Media repeated that line the next day, and used it as a teaching moment for voters?

Me neither.

I made this same argument, by the way, until I was blue in the face. Again, I didn’t see the L.A. Times making the points I did.

Look. People are going to keep being selfish and Big Media is going to keep lying. If Texas wants to secede, maybe I’ll move back.

But I have said it before and I will say it again: we aren’t going to pay this debt. In fact, we aren’t going to seriously try. So at this point, it’s all about when the default happens and what it looks like.

I don’t know all the details, but I know this: it is not going to be pretty.

I demand my pills. I was promised pills. I want them delivered by a Unicorn.

Sandra Fluke (ca54bb) — 11/15/2012 @ 7:39 amCompletely off topic: Pallywood is back

Milhouse (15b6fd) — 11/15/2012 @ 7:57 am“we aren’t going to pay this debt. In fact, we aren’t going to seriously try. So at this point, it’s all about when the default happens and what it looks like.”

Pretty astute for not knowing the details.

Detail 1., The ECB is guaranteeing a floor for the sovereign debt of its members. The floor will be above that of US debt, to ensure buyers.

The $5 Trillion in US debt the Fed will hold at the end of 2014 along with toxic MBS is worth what? Just a guess is fine.

When do you suppose bond purchasers figure this out? After another downgrade?

gary gulrud (dd7d4e) — 11/15/2012 @ 8:01 amNo, we probably won’t ever pay off this debt, or even try, but if we can get the economy growing again we’ll never have to. Debt is a drag, because you have to pay interest on it; but so long as your creditors have confidence in you you never have to pay the principal. You can keep rolling it over forever. The problem only comes when they lose confidence in you because you’re, well, just look at the last few decades. If we can reverse that, then the debt will be reduced to just a huge annoyance.

Milhouse (15b6fd) — 11/15/2012 @ 8:02 amThe House should pass the 2006 budget, then the 2008 pre-stimulus pork orgy budget.

JD (185efa) — 11/15/2012 @ 8:12 amSo what about the 47% who pay no income tax at all? What does Obama think their fair-share should be?

Frankly, I agree with Glenn Reynolds. if the house Republicans were really smart (I know, wishful thinking) they would give the Dems all the tax increases they want and specifically target them in such a way as to fall predominantly on the blue states which scream unendingly for people to pay more in taxes (as per Prof. Reynolds, reviving the 20% tax on gross movie profits would be a good start along with taxing ivy league endowments) and how about a federal real esate tax on any residence worth over 7.5 million? Beverly Hills, are you listening?

After all, to paraphrase Obamacles, there comes a time when Harvard, Yale, Alec Baldwin, Bill Maher and Eva Longoria have made enough money.

T (13d0fd) — 11/15/2012 @ 8:14 amFree stuff such as Obama phones are just the tip of the iceberg. The middle class goodies are not “free”, strictly speaking. No, that would loook bad, and people might even refuse.

Student loans – now, unless you go to Grove City College, the student loans must come from Uncle Sam, who guarantees it regardless of your credit and pays the interest on a lot of it for you for a while (free stuff). It’s hiddeen, and it’s not really optional. And now the administration can buy middle class votes with a mere suggestion of loan forgiveness.

Mortgages. All of those Federal-backed too good to be true no money down packages are not free, but leveraged. How long will it take for all mortgages to go the way of student loans, turning the suburbs into housing projects?

Social security. My parents paid into it for years, they are getting a pittance of what they would have gotten with the same investment pumped into a retirement plan. It’s not free stuff, it’s worse – they take what you have, skimm it, and return it as taxable income combined with government dependency.

Cash for clunkers. Not free outright, just subsidized for suburbanites who would not take an Obama car.

Now we have obamacare, more free stuff you can’t refuse, another way the government forces the middle class into dependency.

Amphipolis (d3e04f) — 11/15/2012 @ 8:15 amHow much of a drag is it? In 2021, the interest alone would be two trillion per year (in current dollars).

And we have one of those variable rate $16 trillion credit cards. What happens when the promotional period expires and our interest goes up?

We are in deep kimchi then.

Dustin (73fead) — 11/15/2012 @ 8:21 amand

Precisely. Why does “either side” HAVE to say it. Shouldn’t the MEDIA be calling them out on it, when they aren’t answering questions they should be answering? ISN’T IT THE MEDIA’s **JOB** to, among other things, be ASKING QUESTIONS of the candidates?

Oh, right. That would have hung their fair-haired (ahem) “boy” (no pejorative intended. It’s a figure of speech. If you don’t like it, eat me.) out to dry before an onslaught of GOP answers for which he had no possible response.

IGotBupkis, Legally Defined Cyberbully in all 57 States (8e2a3d) — 11/15/2012 @ 8:23 amPatterico,

Well, you are living in Ground Zero of the coming US Debt bomb. The cities in California are starting to default on their obligations to CALPERS, some are starting to default on municipal bonds. California has elected themselves a Democratic super-majority in the Cali. Legislature. That’s the start right there. Local governments will lean on state governments for help, state governments will then lean on the Federal government, then the whole house of “implicit guarantees” comes falling down.

There are not enough persons or institution to extract money from. From individuals to the international agencies, the whole system is running on leverage and debt. Except for a few exceptional cases, those with money and assets are using them as collateral in massively leveraged money making schemes.

The Mayans were right, the Great Unwinding is coming. It’s going to be a hell of a ride.

Xmas (05d9ed) — 11/15/2012 @ 8:24 amCan’t be done. That would be a direct tax, and therefore would have to be apportioned, which nobody has any idea how to do.

Milhouse (15b6fd) — 11/15/2012 @ 8:28 amThe nation is safe again, for the people like the LAT subject the day before who went BK twice and welched on two mortgages after borrowing to the hilt against the homes and then was granted another.

BTW Milhous, I noted the fake ambulances and injured babies on the NBC “news” last night as well. Enough time had passed that the useful idiot viewers would accept it as truth.

Patricia (be0117) — 11/15/2012 @ 8:46 amThe nation is safe again, for the people like the LAT subject the day before who went BK twice and welched on two mortgages after borrowing to the hilt against the homes and then was granted another.

BTW Milhous, I noted the fake ambulances and injured babies on the NBC “news” last night as well. Enough time had passed that the useful idiot viewers would accept it as truth.

Patricia (be0117) — 11/15/2012 @ 8:46 amHow can we expect the average citizen to be aware of how taxes and budgeting really work, when even the so-called experts on our side can’t get it right? Witness, this op-ed from Jon Coupal of the Howard Jarvis Tax Association (for you non-Californians, it’s an anti-tax-hike group) in which he amazingly seems to agree (incorrectly) with Governor Brown’s flacks that Prop. 30 only raised taxes on the wealthiest Californians. If someone from the Howard Jarvis Tax Association isn’t clever enough to point out that Prop. 30 raised the state sales tax on all Californians, then I think our side might as well settle in for a period of high taxation.

On a related note, fresh off of the big Prop. 30 victory my state senator is now proposing to triple the car tax again. He, of course, claims that the money will be used for highway construction projects, but everyone knows that money is fungible and it is really going to shore up public employee pension funds.

The social welfare state has failed in Europe, so we might as well try it out here. This is the logic of the new progressive.

JVW (4826a9) — 11/15/2012 @ 9:17 amHow can we expect the average citizen to be aware of how taxes and budgeting really work, when even the so-called experts on our side can’t get it right? Witness, this op-ed from Jon Coupal of the Howard Jarvis Tax Association (for you non-Californians, it’s an anti-tax-hike group) in which he amazingly seems to agree (incorrectly) with Governor Brown’s flacks that Prop. 30 only raised taxes on the wealthiest Californians. If someone from the Howard Jarvis Tax Association isn’t clever enough to point out that Prop. 30 raised the state sales tax on all Californians, then I think our side might as well settle in for a period of high taxation.

On a related note, fresh off of the big Prop. 30 victory my state senator is now proposing to triple the car tax again. He, of course, claims that the money will be used for highway construction projects, but everyone knows that money is fungible and it is really going to shore up public employee pension funds.

The social welfare state has failed in Europe, so we might as well try it out here. This is the logic of the new progressive.

JVW (4826a9) — 11/15/2012 @ 9:17 amIs it any surprise? Ron Paul has been repeating that same message for years. He was ignored.

Michael Ejercito (2e0217) — 11/15/2012 @ 9:24 amSorry for the double post. Got an error message the first time around so I refreshed the page. That must have caused it.

JVW (4826a9) — 11/15/2012 @ 9:25 amPretending to care about the debt didn’t help us elect Republicans.

Time to move on.

Powder Dry (3d5492) — 11/15/2012 @ 9:25 amAmerica: Rise of the Moochers

CrustyB (69f730) — 11/15/2012 @ 9:25 amSorry for the double post. Got an error message the first time around so I refreshed the page. That must have caused it.

JVW (4826a9) — 11/15/2012 @ 9:25 amAmerica: Rise of the Moochers

CrustyB (69f730) — 11/15/2012 @ 9:26 amAmerica: Rise of the Moochers

CrustyB (69f730) — 11/15/2012 @ 9:26 amAdding on to P’s comments, I think the #’s 1-10 priorities for the repubs are to educate the public on fiscal issues above passing or blocking any legislation.

They need to think strategically, not just short term tactics. Rather than fight over tax rates for the rich and play into Obama’s class warfare, let Obama has what he wants and spend time letting peopole know how pitifully little it will do; that if people want to feel good about the rich “paying their fair share” point out how much the rich already pay and how little their paying more will help.

If the conservative repubs communicate what they are doing I think conservs will understand rather than think they are “selling out”.

I don’t know what the truth is, but I hear Jindahl being quoted as saying things that (I think) alienate him from strong conservatives.

Race 2016 divide and conquer already underway.

MD in Philly (3d3f72) — 11/15/2012 @ 9:28 amAdding on to P’s comments, I think the #’s 1-10 priorities for the repubs are to educate the public on fiscal issues above passing or blocking any legislation.

They need to think strategically, not just short term tactics. Rather than fight over tax rates for the rich and play into Obama’s class warfare, let Obama has what he wants and spend time letting peopole know how pitifully little it will do; that if people want to feel good about the rich “paying their fair share” point out how much the rich already pay and how little their paying more will help.

If the conservative repubs communicate what they are doing I think conservs will understand rather than think they are “selling out”.

I don’t know what the truth is, but I hear Jindahl being quoted as saying things that (I think) alienate him from strong conservatives.

Race 2016 divide and conquer already underway.

MD in Philly (3d3f72) — 11/15/2012 @ 9:29 am“L.A. Times: Californians Favor Having Other People Pay for Their Free Stuff”

In other breaking news, an L.A. Times investigative reporter has discovered that the Pope is Catholic.

Dave Surls (46b08c) — 11/15/2012 @ 10:20 am___________________________________________

The L.A. Times say

I wonder how leftwing newspapers manage to survive in countries like Greece, or, closer to home, Mexico? In a way they’re like cockroaches, because no matter how screwed up conditions become in the society that surrounds them, they still somehow manage to keep their doors open. (BTW, the same thing applies to other facets of the economy in general—the tenacity of humans).

I know there have been reports of Mexican reporters being assassinated by members of the drug cartel, and since that society is a window into California’s future, it’s not an absurd hypothetical to guess that people in the MSM of the USA (or certainly its sub-sections like LA/Calif) eventually will need combat pay.

Mark (5bf7b1) — 11/15/2012 @ 10:23 am___________________________________________

The L.A. Times say

I wonder how leftwing newspapers manage to survive in countries like Greece, or, closer to home, Mexico? In a way they’re like cockroaches, because no matter how screwed up conditions become in the society that surrounds them, they still somehow manage to keep their doors open. (BTW, the same thing applies to other facets of the economy in general—the tenacity of humans).

I know there have been reports of Mexican reporters being assassinated by members of the drug cartel, and since that society is a window into California’s future, it’s not an absurd hypothetical to guess that people in the MSM of the USA (or certainly its sub-sections like LA/Calif) eventually will need combat pay.

Mark (5bf7b1) — 11/15/2012 @ 10:23 amComment by Dustin — 11/15/2012 @ 8:21 am

And we have one of those variable rate $16 trillion credit cards. What happens when the promotional period expires and our interest

goes up?

It won’t expire for about two years at least.

Now what the president – any president – needs to do is to permanently lock in a low rate. Either maintain control of interest rates, like Roosevelt and Truman did until March 4, 1951, or refinance even if it means you’ll be paying a higher rate in the immediate future.

Sell 60 year 70 year 71 year year 72 year (can’t have all these bonds expiring in the same year) even perpetual bonds. Long long term Treasury bonds. And now’s the time to do it, when the Euro is heading toward collapse. Even if it raises the Fisscal 2014 deficit by many billions.

Sammy Finkelman (b7434f) — 11/15/2012 @ 10:25 amCA Mentality:

Increase taxes on business HQ’s out-of-state for the privilege of doing business in CA.

We’ll get the outsider to pay for our free stuff.

I wonder what Amazon is thinking now after they made that deal with Moonbeam, and then set-up a warehouse (whatever) in CA since they were now subject to Sales Tax and had no reason not to have a physical presence within the State, and now they get stuck with a new tax on Corporate Profits?

No Good Deed goes unpunished.

askeptic (b8ab92) — 11/15/2012 @ 10:32 amColor me an Ex-Amazonian!

Out-of-State business tax increase: Prop-39!

askeptic (b8ab92) — 11/15/2012 @ 10:51 amThat makes perfect sense.

The only problem is that it doesn’t make short term sense, which is the only kind of sense likely to matter to Obama. He is more than happy to kick the can down the road on that.

Furthermore, cloward pivens.

Dustin (73fead) — 11/15/2012 @ 10:54 amFirst of all, you don’t have to feel bad for the voters. Look at what the voters have done to Kali. They kept blaming the very existence of conservatives as the only thing standing in the way between them and bountiful supplies of free stuff and clean air and water.

How you’re going to get all that free stuff when you shut down manufacturing, oil drilling, businesses in the name of clean air and clean water (when the air and water are already clean) I’ll never know. But if they’re going to vote for diametrically opposite things no amount of explaining will do it.

It’s like the Occupiers. They hate corporate America. They love their iPads and laptops and all the other conspicuous-consumption type products.

As Pat points out Ryan tried to explain that you can’t balance the budget by taxing “the rich.” As IGotBupkis, Legally Defined Cyberbully in all 57 States points out it should be the media’s job to explain it even if it hadn’t.

Let it be an abject lesson; the media will make sure the message doesn’t get out if Paul Ryan explains it. That’s what they see their job as. They’re the propaganda arm of the liberalism. Now they can pretend no one on either side explained it, when one side did, so they can blame Mitt Romney and Paul Ryan just as much as anyone else.

It’s not true and they know it, but that’s what propagandists do.

Anyhow, my image of a Kali voter is that woman in the press reports who exclaimed “What are they doing to us” when she pulled into a gas station and saw gas had gone to $6/gal.

My reaction: What do you mean “they” honey?

The remaining Kali voters do it to themselves. Unfortunately, they’ll always blame that mysterious “they” when they get what they voted for. Right now it’s anyone making more than $200k. Soon it’ll be anyone with a job who owns their own home.

But they’ll always vote for things that “they” have to pay for because in addition to getting free stuff themselves that’s the new definition of generosity. You’re mean spirited if you don’t vote for a “generous” government. Like Mitt Romney, who gives away half his income when you combine his taxes with his charitable giving.

So what, said Joe Biden. That’s just his “personal generosity.” It used to be there was no other kind. Now there’s no higher form of generosity than the above “public generosity.”

Steve57 (7a880e) — 11/15/2012 @ 10:57 amPerhaps this wasn’t clear. In the name of “clean air” Kali voters have given themselves a system where they have to use their own special summer & winter blends of gas. If theres a problem at one of the few refineries that produce it (it could be only one) they can’t get it anywhere else. That’s on top of what the price of barrel of oil will do the the price of gas at the pump.

But the thing is, Kali voters never expected to have to pay that price at the pump. And if any conservative pointed out that after a certain point these clean air initiatives were counter productive, providing no additional health benefits because the air quality wouldn’t improve by any discernible measure but it would be costly nonetheless, they were obviously in favor of polluting the air and poisoning children.

It doesn’t matter that we were proven right. What matters is that Obama knew his base. Just like he’s never wrong, they don’t make mistakes. And like him, they are out for revenge on the people who by their very existence are somehow standing between them and the perfect though contradictory world they voted for. Corporate consumer products without the corporations.

Steve57 (7a880e) — 11/15/2012 @ 11:10 amhttp://www.dailymail.co.uk/news/article-2233221/Dennys-charge-5-Obamacare-surcharge-cut-employee-hours-deal-cost-legislation.html

There’s a lot of good info in the article, especially how to pay for the approved ObamaCare plan (as opposed to their current plans; as we learned from Sandra Fluke “free” contraceptives aren’t cheap) would cost $5K an employee many of his restaurants don’t make enough to cover it.

He uses the example of a Denny’s with 35 employees. That’s $175k/year. Anyone who’s ever eaten at Denny’s has to know most don’t clear that in a year.

But this article illustrates a point I was making earlier. The people voting for free stuff would be “turned off” if he explicityly charges them for the cost of ObamaCare. Instead of hiding the cost by just raising prices.

These are the revenge voters Obama was appealing to. They get angry with people who point out the effects of getting what they voted for.

Steve57 (7a880e) — 11/15/2012 @ 11:53 amFor your delectation: Welcome to Fantasyland

Space Cockroach (8096f2) — 11/15/2012 @ 12:08 pmhttp://www.sacbee.com/2012/11/15/4987295/analyst-sees-potential-for-budget.html

For your delectation: Welcome to Fantasyland

Space Cockroach (8096f2) — 11/15/2012 @ 12:09 pmhttp://www.sacbee.com/2012/11/15/4987295/analyst-sees-potential-for-budget.html

For your delectation: Welcome to Fantasyland

Space Cockroach (8096f2) — 11/15/2012 @ 12:09 pmhttp://www.sacbee.com/2012/11/15/4987295/analyst-sees-potential-for-budget.html

Everybody get that?

Space Cockroach (8096f2) — 11/15/2012 @ 12:35 pmSF: Long long term Treasury bonds. And now’s the time to do it, when the Euro is heading toward collapse.

31. Comment by Dustin — 11/15/2012 @ 10:54 am

That makes perfect sense.

The only problem is that it doesn’t make short term sense, which is the only kind of sense likely to matter to Obama.

I know, I know, I know. It would make the budget deficit look greater in the next few years. It doesn’t appeal to most people in Congress either, I suspect..

He is more than happy to kick the can down the road on that.

Furthermore, cloward pivens.

I don;t know what cloward pivens means..

An ANAGRAM?

Sammy Finkelman (d22d64) — 11/15/2012 @ 12:45 pmComment by Steve57 — 11/15/2012 @ 11:53 am

The people voting for free stuff would be “turned off” if he explicityly charges them for the cost of ObamaCare.

That’s what he did. It’s called the individual mandate. But it is always described in teerrms of people “getting” insurance.

For people who just can’t afford it – Obamacare offers Medicaid.

There cannot be a more economically destructive program than Medicaid.

Not only does Medicaid have an income test, it has asset tests. It even has clawbacks. And even Mitt Romney’s accountant couldn’t easily fill out the forms truthfully and accurately.

Sammy Finkelman (d22d64) — 11/15/2012 @ 12:48 pmThen you really need to find out. It is impossible to credibly comment on modern American politics without knowing about Cloward and Piven, and their strategy for bringing about socialism in the USA. Almost as impossible as doing so without having heard of Saul Alinsky.

Milhouse (15b6fd) — 11/15/2012 @ 1:18 pmshooting at the walls of heartache

BANG BANG

me i am the warrior

happyfeet (a74101) — 11/15/2012 @ 1:23 pmThe problem with that is lots of the bonds are just bought by the Fed. They don’t have buyers for all the bonds as it is. Why would people want to be locked in for 60 years when aren’t committing to 10 years?

Gerald A (f26857) — 11/15/2012 @ 1:35 pmTexas isn’t going to withdraw from the Union. But I think there’s a reasonably good chance we’ll see federal martial law declared in some part or parts of California before the end of Obama’s second term.

Beldar (22f646) — 11/15/2012 @ 1:38 pmFWIW, I do support the right of return of peaceful, law-abiding, and gainfully employed or employable Texas ex-pats.

Beldar (22f646) — 11/15/2012 @ 1:41 pmYou should come back, Pat.

DRJ (a83b8b) — 11/15/2012 @ 1:53 pmI hereby declare myself a Texican for the purpose of repatriation.

askeptic (b8ab92) — 11/15/2012 @ 1:57 pmI even stayed at Lackland and Goodfellow for extended periods a long time ago.

Forget investment grade bonds and public equities. Californians worried about underfunded and overpromised retirement obligations of their various municipal and state units just need to take a more aggressive posture with the invested assets of existing plan assets. Done right, virtually all risk can be eliminated while leveraging returns beyond your wildest imagination. The world of swaptions, CDOs, CDS’, etc., awaits.

Orange County is a distant memory and just did not have to proper risk management tools to stay on top of and properly diversify their portfolio. They were amateurs!

What do you have to lose?

daleyrocks (bf33e9) — 11/15/2012 @ 2:03 pmI think OC relied to heavily on Merril, if memory serves me.

askeptic (b8ab92) — 11/15/2012 @ 2:11 pmStock market down today. That Mr. Dow Jones is sure a racist!

Patricia (be0117) — 11/15/2012 @ 2:15 pmI’m in love with Sanderson Texas if I ever get to where I can just telecommute I might would move there for a spell

happyfeet (a74101) — 11/15/2012 @ 2:17 pmThat’s all right, Patricia. He’ll straighten out after he gets a stern letter from CalPers warning that they’ll pull all of their funds if Mr. Dow continues misbehaving.

askeptic (b8ab92) — 11/15/2012 @ 2:20 pm“I think OC relied to heavily on Merril, if memory serves me.”

askeptic – You could get into straddles on algae-based fuel sold to the Navy. Under Obama you know that’s going to be huge even with defense cutbacks!

daleyrocks (bf33e9) — 11/15/2012 @ 2:30 pmBTW, I am in no way purporting to give investment advice on this blog.

daleyrocks (bf33e9) — 11/15/2012 @ 2:31 pmalgae-based fuels….

askeptic (b8ab92) — 11/15/2012 @ 3:02 pmWell, when it clogs the fuel strainers, and the engines stop, you can always eat the algae as a side-dish to the raw fish – since they won’t have any power to cook stuff.

you can always eat the algae

Soylent Red, I believe

MD in Philly (3d3f72) — 11/15/2012 @ 3:25 pmBecause California’s democratic super majority is genetically unable to not spend other people’s money. This after Prop 30 just passed, giving the state a gazillon more taxpayers’ dollars.

<Touted as a test of the new Democratic supermajority in Sacramento, South Bay state Sen. Ted Lieu plans to introduce a measure to triple vehicle license fees.

The constitutional amendment would restore the 2 percent vehicle license fee slashed by Gov. Arnold Schwarzenegger after he won office partly on that pledge.

The 1.35 percent transportation system user fee increase would generate an estimated $3.5 billion to $4 billion annually for roads and public transit in yet-to-be-decided proportions, Lieu said.

http://www.contracostatimes.com/california/ci_21998781/vehicle-license-fees-would-triple-under-measure-planned

Dana (292dcf) — 11/15/2012 @ 4:14 pmDana– do you and your family have any thoughts about leaving Cali? What more would have to happen for you to consider it? And at what point will it be too late? I inquire only because we in IL are following the same one party path to financial destruction and taxation hell as Cali. When one loves a place it’s hard to consider leaving–but at some point one must face reality. The human urge within us to survive is strong.

elissa (2aea2a) — 11/15/2012 @ 4:28 pmBecause of the kookoo-bananas BS he said before and after it.

Rob Crawford (d8dade) — 11/15/2012 @ 4:33 pmElissa, that’s a good question. I’m not sure what the tipping point will be. Our kids are here, making it tough to leave, as well as an aging parent we care for. And we already own a cabin in the woods we plan to move in when we retire. However, now that there’s a super majority rule, we may be forced out by the inevitable whorish spending/taxing. We’re in ‘wait and see’ mode….

I’ve been to Texas and “flat” just doesn’t appeal to me.

Dana (292dcf) — 11/15/2012 @ 4:52 pmMy brothers and I took care of our parents for twelve years. My father cursed me for keeping him alive. My mother did not have the mental capacity to curse me. Medicare took care of the hospital bills. My brothers and I paid the two caregivers. I signed my mother’s DNR order when she could no longer swallow. Just shut the f*** up. You don’t know s*** from shinola.

nk (875f57) — 11/15/2012 @ 5:05 pmCan’t be done. That would be a direct tax, and therefore would have to be apportioned, which nobody has any idea how to do.

Comment by Milhouse — 11/15/2012 @ 8:28 am

You’ve got to be kidding Milhouse. After the Kelo v London, and especially the Obamacare ruling where SCOTUS changed explicit language of penalty to tax, anything is now possible. It wouldn’t surprise me if the next tax for not participating in interstate commerce is pushed through for not buying a Government Motors Corp Volt. Don’t buy a Volt, then you will be penalized (taxed according to SCOTUS) $5,000.00 per year. Under SCOTUS’ Obamacare ruling you can be penalized (taxed) for not participating in any type of Interstate Commerce that Congress and President decide.

peedoffamerican (ee1de0) — 11/15/2012 @ 5:15 pmThe best Mexican food I ever ate was at a dinky little restaurant in Sanderson, TX. Sopapillas to die for. Good choice, HF.

PatAZ (d1234f) — 11/15/2012 @ 5:24 pmAnd how do you suppose you’d get a Supreme Court majority for such a tax? Do you think any of the socialists would vote for it, merely for the sake of consistency?!

Milhouse (15b6fd) — 11/15/2012 @ 5:27 pmThe conservatives will oppose it because it’s unconstitutional, and the socialists will oppose it because it hurts them.

Milhouse (15b6fd) — 11/15/2012 @ 5:27 pmPOA is righter. There are cases for imputed tax, where you get taxed for the income you could have gotten.

nk (875f57) — 11/15/2012 @ 5:27 pmimputed *income*, if you wish

nk (875f57) — 11/15/2012 @ 5:29 pmCase on the books. Priest took homeless person into his home. Got taxed on the rent he should have charged. You can be taxed for painting your own living room.

nk (875f57) — 11/15/2012 @ 5:32 pmMilhouse, the liberals just don’t care who it hurts, it’s all about power to them, otherwise, they would not have upheld Kelo or Obamacare. Remember, it’s the libs that are never concerned with unintended consequences even though conservatives warn the people b4 they occur and shout ‘We told you so’, afterwards. Also, don’t you remember Obummers battle cry? “Make the rich pay their fair share!”

NK, they have a tax in Georgia on trees that are not harvested for lumber. You pay a tax for their value every year they are not harvested, and then when you do harvest them, they tax you on that.

peedoffamerican (ee1de0) — 11/15/2012 @ 5:38 pmRichard Cloward and Francis Piven (they were married) wrote an article, “The Weight of the Poor: A Strategy to End Poverty,” calling for the Democrat Party to enact policies that result in the US entitlement system to be overloaded and unsustainable, while campaigning on high awareness of this welfare (for example, food stamps). As too many recipients apply for benefits (and vote for the democrats who continue to reduce the threshold to get them) this plan would cause a crisis that would be resolved with guaranteed annual income (AKA outright socialism).

Francis Pivens was a leader in the “New Party”, which Barack Obama was also a supporter of, leading many to suspect he is on board with this radical plan. It does explain things.

It’s hard for me to accept that people really think this way, but I’m naive.

Dustin (73fead) — 11/15/2012 @ 5:46 pmWhat case?

Milhouse (15b6fd) — 11/15/2012 @ 5:48 pmYou’re not making any sense. This is not about unintended consequences, it’s about intended ones. You’re proposing that the Rs pass a tax on rich Ds’ homes. I’m saying the honest judges will strike it down because it’s a direct tax, and the dishonest ones will strike it down because it hits their friends.

Milhouse (15b6fd) — 11/15/2012 @ 5:51 pmPiven, and he wasn’t just a supporter, he was a member, and sought and received its endorsement for office.

Milhouse (15b6fd) — 11/15/2012 @ 5:52 pmYou don’t care about the debt

sleeeepy (b5f718) — 11/15/2012 @ 5:54 pmYeah, I always say ‘Pivens’ when it’s ‘Piven.’

The context makes it sound like Milhouse is describing Ms Pivens, but he’s talking about Obama. And he’s right. Obama supported what is essentially the ‘ruin American into socialism’ party, and that party supported Obama right back.

Isn’t it amazing that Obama won a major election with this kind of history?

Dustin (73fead) — 11/15/2012 @ 6:07 pmGah, he’s back. Idiot, those are the tax cuts for ordinary people, which nobody is proposing to repeal. Not 0bama, not the Dems, nobody. So they’re nothing to do with Bush, except that he gets the credit for having originally introduced a popular measure. And, by the way, a revenue raising measure, so how the author of this chart claims it adds to the debt is very strange. If enacting the cuts raised revenue, as it did, then how can repealing them also raise revenue?

Milhouse (15b6fd) — 11/15/2012 @ 6:08 pmAgain, 0bama didn’t just support the New Party, he was a party member. Filled in an application form, paid membership dues, the works. And he was an endorsed party candidate. Of an actual honest-to-god communist party.

Milhouse (15b6fd) — 11/15/2012 @ 6:14 pmYou’re not making any sense. This is not about unintended consequences, it’s about intended ones. You’re proposing that the Rs pass a tax on rich Ds’ homes. I’m saying the honest judges will strike it down because it’s a direct tax, and the dishonest ones will strike it down because it hits their friends.

Comment by Milhouse — 11/15/2012 @ 5:51 pm

If they didn’t strike down Obummercare, they won’t strike down this either because they basically ruled that “Everybody has to pay their fair share”.

Do you know what the ruling means in reality? It basically over rules the 13th amendment against slavery. Even though no private person owns you, the ruling says that the government owns you, and can find a reason to tax you for anything.

Here’s something for taxing you unjustly NK.

Mr. De Grazia said he burned them because the Internal Revenue Service, by comparing his work with market values, made him ”a millionaire on paper and my heirs will have to pay taxes for which there is no money.”

Or how about taxing you for something that you cannot legally sell;

Because the work, a sculptural combine, includes a stuffed bald eagle, a bird under federal protection, the heirs would be committing a felony if they ever tried to sell it. So their appraisers have valued the work at zero.

But the Internal Revenue Service takes a different view. It has appraised “Canyon” at $65 million and is demanding that the owners pay $29.2 million in taxes.

And Milhouse doesn’t think that they will tax multi-million dollar homes? Maybe you forget about this tax and the unintended consequences of it?

Luxury Tax on Yachts to Soak the Rich Cripples Boat Making Industry

peedoffamerican (ee1de0) — 11/15/2012 @ 6:16 pmI’m not disagreeing.

It’s too bad this wasn’t a huge campaign theme, along with charts showing enormous growth in food stamp use, the debt, etc.

Dustin (73fead) — 11/15/2012 @ 6:18 pmComing up next. Due to Global Warming, errrr, Climate Change, President Obama issues Executive Order for regulation of Carbon Dioxide by the Environmental Protection Agency. EPA then issues tax/penalty for CO2 exhaled by US citizens. The penalty will be based upon exhalations per minute per person in each household and will be collected by the Infernal Revenue Service. Think you can escape this by dying? Not likely! Your estate will also be penalized in the event of your death for the CO2 released as a result of decomposition.

Ridiculous? Yes, but I wouldn’t put it past them.

peedoffamerican (ee1de0) — 11/15/2012 @ 6:26 pmIf they can tax/penalize me for not buying something and have it upheld by SCOTUS, then they can damn well tax me for just about anything, even breathing?

peedoffamerican (ee1de0) — 11/15/2012 @ 6:29 pmOops, even breathing!

peedoffamerican (ee1de0) — 11/15/2012 @ 6:29 pmTocqueville knew of this danger, and he believed that Judeo-Christian values were important for preventing it:

It must be acknowledged that equality, which brings great benefits into the world, nevertheless suggests to men (as will be shown hereafter ) some very dangerous propensities. It tends to isolate them from one another, to concentrate every man’s attention upon himself; and it lays open the soul to an inordinate love of material gratification.

The greatest advantage of religion is to inspire diametrically contrary principles There is no religion that does not place the object of man’s desires above and beyond the treasures of earth and that does not naturally raise his soul to regions far above those of the senses.

Religious nations are therefore naturally strong on the very point on which democratic nations are weak; this shows of what importance it is for men to preserve their religion as their conditions become more equal.

…The chief concern of religion is to purify, to regulate, and to restrain the excessive and exclusive taste for well-being that men feel in periods of equality; but it would be an error to attempt to overcome it completely or to eradicate it. Men cannot be cured of the love of riches, but they may be persuaded to enrich themselves by none but honest means.

Tony (2a43e2) — 11/15/2012 @ 6:49 pmUnemployment claims up in Ohio and Pennsylvania.

http://www.breitbart.com/Big-Government/2012/11/15/Surprise-Jobless-Claims-Up-Over-75000

peedoffamerican (ee1de0) — 11/15/2012 @ 6:57 pmAlinsky, Cloward, and Piven

Had you told me 10 years ago that there were such people openly advocating what they have written I would not have believed you. Beck sounded like looney-tunes when he first started about Alinsky. (Some may say he still sounds like looney-tunes, but unfortunately he has a track record of being ahead of the game).

MD in Philly (3d3f72) — 11/15/2012 @ 7:01 pmI read deTocqueville when young. It is a snap of America at Daniel Boone time. Long way still to go.

nk (875f57) — 11/15/2012 @ 7:02 pmelissa, if you are in IL (like a lot of my family) you might consider Indiana. It’s on the upswing and has sensible leaders, at least so far.

I want to leave CA too but family keeps me here. Park City Utah appeals to me–cool place for the non-Mormons in a traditional state.

Patricia (be0117) — 11/15/2012 @ 7:02 pmComment by peedoffamerican — 11/15/2012 @ 6:57 pm

To quote Gomer Pyle, “Surprise, surprise, surprise!”

MD in Philly (3d3f72) — 11/15/2012 @ 7:02 pmSlurpy woke up, puked out a disingenuous link, and passed right back out. The horrific Obama/Pelosi/Reid tax cuts add(with static scoring)!around 90B a year? They always talk about the 10 year costs to make it seem worse. 90B accounts for less than 10% of every trillion dollar plus deficit that Teh One has produced. And the discuss of tax rates is about the size of the entire package, middle class and all. Dems just loathe the wealthy and want to take more from those that already pay a disproportionate share of the taxes. If they took ALL of the wealthy’s money, it would not fix the spending problems.

JD (185efa) — 11/15/2012 @ 7:04 pmAnd they call “tea baggers” extremists for asking for a balanced budget.

The world is upside down.

Dustin (73fead) — 11/15/2012 @ 7:06 pmWhat kind of comparison is that? 0bamacare hits everybody. And in any case the leftists on the court upheld it not as a tax but as a valid regulation of imputed commerce. It was Roberts who had to see it as a tax. In this case, it’s a tax that is clearly direct, and is aimed squarely at their own friends. How do you imagine they’d uphold it?

What the @#$% are you talking about? This was always the case, the 0bamacare ruling doesn’t change that one iota. There was never any question that if Congress had passed 0bamacare as a tax it would have been constitutional; the only question before the court was whether it had done so, since at the time it insisted that it hadn’t. The majority said that didn’t matter, Congress lied. What matters is what it does, not what it says. But everyone agreed that Congress had the power to impose an indirect tax.

But a real estate tax is a direct tax. There is no getting around that. The honest judges would have to strike it down. And the dishonest judges would want to strike it down. So it would fail 9-0.

Milhouse (15b6fd) — 11/15/2012 @ 7:08 pmIS CALIFORNIA TAXPAYERS COMMITTED TO SUBSIDIZE ILLEGAL IMMIGRANTS FOREVER?

BEFORE ANY PASSAGE OF IMMIGRATION REFORM FINDS ITS WAY THROUGH THE CONGRESS, TWO BILLS ARE A NECESSITY TO EVENTUALLY STOP THE INGRESS OF ANY MORE FLOWS OF ILLEGAL IMMIGRANTS. 1. THE LEGAL WORKFORCE ACT CONTAINING MANDATORY E-VERIFY AND HALT ILLEGAL ALIENS TAKING JOBS AND HOLDING EMPLOYERS ACCOUNTABLE. 2. A SIMPLE AMENDMENT TO END THE BIRTHRIGHT CITIZENSHIP BILL TO STEM THE INFLOW OF SMUGGLED BABIES EITHER UNBORN OR AS AN INFANT, INTO THE UNITED STATES TO GAIN INTENTIONAL RIGHTS TO BE A CITIZEN AND A MASSIVE FINANCIAL BURDENING THE U.S. TAXPAYER. 3. THE REINTRODUCTION OF FORMER PRESIDENT BUSH 2006 SECURE FENCE ACT IN ITS ENTIRETY. THIS IS A DOUBLE PARALLEL FENCE STRETCHING ALONG THE BORDER OF THE U.S STATES AND ITS SOUTHERN NEIGHBOR. AMERICA MUST REDUCE SANCTUARY CITIES, CHAIN MIGRATION AND THE ILLEGAL ALIEN INVASION. 4. A GOVERNMENT ISSUED PICTURE ID CARD, WHICH CONTAINS INFORMATION TO USE IN PROVING WHO YOU ARE?

MULTIBLE LIES COMING FROM THE DEMOCRATIC MAJORITY ASSEMBLY

Stephen Frank Stated on 11/14/2012 on California deficits as follows at http://capoliticalnews.com/

In the past two months, the cash deficit of the State has gone from $22.3 billion to $24.7 billion—just for the first four months of the year.

Plus the State OWES $12.5 billion to K-12 education It owes $15 billion stolen from Trust Funds to cover cash deficit

It owes $10 billion BORROWED to cover the rest of the cash deficit.

The State owes the Feds $10 billion for the loan to the unemployment insurance fund—so California can continue to send out unemployment checks.

That is a total of $71.5 billion—and there is more. Yet, the State claims “California faces a $1.9 billion deficit through June 2014, significantly smaller than in recent years after voters passed two tax initiatives last week, the nonpartisan Legislative Analyst’s Office said last Wednesday”

They claim we will have this small deficit, instead of $71 billion because of the $9 billion Prop. 30 is going to bring in, in new revenues! Any wonder our kids are illiterate—this is the math taught in our schools. Government lies—and tries to make you feel good about being insolvent.

Seems like marijuana must be legal in government offices, he has studied.

California has the highest population of illegal aliens who have settled there. Thousands of children of illegal alien parents gaining automatic citizenship and the cost is thrown at the taxpayers. Health care and other free handouts that are the right of citizens is being disbursed to anybody who sneaks across the border or steps off a plane. None of the 50 states is exempt from this silent attack on our country or the pilfering of their general treasuries. Now the Democrats have their majority public entitlements will be pouring out across the state to all the “Freeloader voters” the spongers and the people who have no intention of finding a job.

Dave Francis (6fba28) — 11/15/2012 @ 7:10 pmComment by Dustin — 11/15/2012 @ 7:06 pm

And for asking legislators to actually read bills before they vote on them- the nerve of those constituents.

Indeed, Dustin. Not only are there hares with watches and waistcoats jumping about, but they are HUGE!

MD in Philly (3d3f72) — 11/15/2012 @ 7:10 pmPlease correct me, but I have read de Tocqueville as a treatise on populism.

nk (875f57) — 11/15/2012 @ 7:15 pmALLCAPS WALL O’TEXT !!!!!!!!!!!!

JD (185efa) — 11/15/2012 @ 7:18 pmThey can’t tax you for not buying something; they can tax your income for whatever purpose they like, and the 0bamacare “penalty” tax is levied as a proportion of your income. A tax on breathing would surely be a direct tax, since it would be the same for everybody, and you can’t not breathe.

Milhouse (15b6fd) — 11/15/2012 @ 7:20 pmRead Fanny Trollope.

Milhouse (15b6fd) — 11/15/2012 @ 7:22 pmAnd what little I could read before my eyes started to hurt was incoherent

Milhouse (15b6fd) — 11/15/2012 @ 7:34 pmI was at a seminar during a Sci Fi Convention we were covering Taxation. in responce to a question on Tax Rates one of the panelists proclaimed 90% for the Rich was not excessive.

Got to thinking 10% return on investment is pretty good now, but 90% Tax Rate would leave ROI of 1% why not invest in non Taxable bonds increase your return 200 to 300 per cent and Pay ZERO Taxes?

Dan Kauffman (2ee9ce) — 11/15/2012 @ 8:49 pmMilhouse, you are living in your own little fantasy world if you don’t think that they can tax you for just about anything.

They can’t tax you for not buying something; they can tax your income for whatever purpose they like, and the 0bamacare “penalty” tax is levied as a proportion of your income. A tax on breathing would surely be a direct tax, since it would be the same for everybody, and you can’t not breathe.

Comment by Milhouse — 11/15/2012 @ 7:20 pm

They are taxing you for not buying something; Government approved health insurance. That is why it was called a penalty, they were penalizing you for NOT purchasing health insurance. I can’t not breathe, and I can’t not live either unless I buy their mandated f$cked up, cover everything under the sun including abortions, that I as a male will probably never need unless some evil genius figures out how to impregnate men, or I will be penalized according to statute but taxed according to SCOTUS. So how in hell do you figure that this is not a direct tax?

They are directly levying a tax penalty on everyone in this country just for existing! And don’t give me crap about it just being based on income either, because that makes it worse. Those that make less or on govt dole will have their cost subsidized by the people making more.

If they can levy a tax, penalty, or whatever they want to call it , just for existing, and have it upheld by SCOTUS, you damn well better believe that they could directly tax your ass for breathing, because that is what they are doing via the Obamacare tax/penalty!

The Affordable Care Act aka Obamacare taxes/penalizes you for NOT buying their government approved health insurance. Ever hear of the exchanges that are to be set up with the approved plans? But you will not be taxed/penalized for buying their POS policy except thru higher premiums.

Is English your second language, or do you just play at being ignorant?

peedoffamerican (ee1de0) — 11/15/2012 @ 9:25 pmAnd also, it is not an income tax. It is a direct tax on each person that does not buy a government approved health policy. And even though the amount of penalty is based on income, it also has an upper limit on the amount of penalty that is collected, therefore it is not an income tax. Income tax doesn’t stop taxing you past a certain point of income, this penalty does. If it were an income tax, then everyone would have to pay it regardless of whether they purchased govt approved insurance or not. They are only using the Infernal Revenue Service as the collection agency.

peedoffamerican (ee1de0) — 11/15/2012 @ 9:49 pmAnd here’s the sad thing about SCOTUS’ ruling. They ruled it a constitutional commerce tax for not participating in interstate commerce when health insurance is not an interstate commerce to begin with. It is intrastate commerce because health insurance is prohibited at this time from being purchased across state lines. Hence the need for each state to set up their own exchanges within that state with the US government approved policies.

peedoffamerican (ee1de0) — 11/15/2012 @ 10:01 pmThat’s what they said they were doing, but the court looked at the actual legislation and found that wasn’t what it actually did. What it actually did was impose a tax on income, and exempt those who bought insurance.

Because it’s taxing your income, not you, and you can avoid it without buying insurance, by not earning enough money to trigger it.

No, they are not. You are not telling the truth.

And that makes it an income tax, which is therefore indirect and constitutional. You’re contradicting yourself now.

Your premise is wrong, therefore so is your conclusion.

Neither. But you are either stupid or dishonest.

FICA, which is also a tax on income, does.

Those who buy insurance get an exemption from the tax. That’s all. There’s nothing unconstitutional about exempting certain people from a tax; that doesn’t magically turn an income tax into a poll tax. Suppose Congress granted an exemption from income tax to all members of the Armed Forces; would that stop it being an income tax?!

Milhouse (15b6fd) — 11/15/2012 @ 10:06 pmNo Milhouse, FICA taxes are not income taxes but come under the 1939 Social Security act. While the may be based on amount of income earned, they are not levied as an income tax.

peedoffamerican (ee1de0) — 11/15/2012 @ 10:33 pmIf they can tax your money when you earn it, again when you invest it, when you take it out of your IRA, when you die and when your kid inherits what’s left, they can tax ANYTHING.

Patricia (be0117) — 11/15/2012 @ 10:48 pmPOA, you are full of sh*t. FICA is a tax on income. That’s what it is. You can’t just say it’s not and expect reality to conform to your words, any more than you can say a square is a circle, or 2+2=3. You’re fuller of sh*t than sleeeeeeepy and Chimperor put together.

There is nothing in the constitution preventing any of the above taxes. They can tax your income, your investments, your deposits, your withdrawals, your estate, or any other activity as much as they like. Taxing an activity is an indirect tax, and there is no limit on federal indirect taxes. But they cannot tax you, or your property, merely for existing. Not without apportioning it among the states according to their population. That’s the constitution for you. And nothing in the 0bamacare decision changes that. The tax proposed here, on houses worth over $7.5M, would be a direct tax, so the honest justices would strike it down. It would be a tax aimed directly at the Democrat judges’ friends, so they would strike it down too. POA can bluster all he likes, but he has not demonstrated that such a tax could pass.

Milhouse (15b6fd) — 11/15/2012 @ 11:08 pm“Because it’s taxing your income, not you, and you can avoid it without buying insurance, by not earning enough money to trigger it.”

Milhouse – You can avoid it be being a member of certain religious groups, which makes it not an income tax, so your premise is wrong.

daleyrocks (bf33e9) — 11/15/2012 @ 11:28 pm____________________________________________

Tocqueville knew of this danger, and he believed that Judeo-Christian values were important for preventing it:

That’s fascinating because it makes me think of the observations made by Benjamin Franklin who (presuming the quote is accurate) said that when the people can vote themselves money from the Treasury, that will spell the end of the Republic. Or in so many words, when people become greedy and lazy, the underpinnings of a nation — including its government — wear out and eventually exhibit dysfunction and dishonesty.

Even several generations ago, the basic foibles of human nature were quite obvious to various analysts of their time. In general terms, the cruddy, corrupt nature of left-leaning sentiments has been evident through the centuries.

Mark (5bf7b1) — 11/15/2012 @ 11:51 pmHuh? You’re just making my point stronger. That’s two ways to avoid it besides buying insurance, which is a third way, so it’s certainly not a tax on merely existing. And how exactly does a religious exemption make it not a tax on income? Religious groups, like all non-profits, are exempt from the income tax too, you know.

Milhouse (15b6fd) — 11/16/2012 @ 12:42 amAccording to wikiquote, “There is no evidence that Franklin ever actually said or wrote this, but it’s remarkably similar a quote often attributed, without proper sourcing, to Alexis de Tocqueville and Alexander Fraser Tytler”.

Milhouse (15b6fd) — 11/16/2012 @ 12:47 amNo Milhouse , you are the ones that’s full of scheiss, but still doesn’t know scheiss! Income Tax is a direct tax, you know the little ole amendment they had to pass in order to levy direct taxes.

Amendment 16 – Status of Income Tax Clarified

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

I can see you don’t know scheiss about direct and indirect taxes.

Under SCOTUS Affordable Care Act ruling, Congress is directly requiring every US Citizen to purchase a product from private enterprise, and a penalty/tax if you do not. THEY ARE NOT TAXING YOUR INCOME, only the ability of you to buy the insurance, receive a subsidy, or pay the penalty/tax if you do not.

I can escape paying income taxes by having no taxable income, I cannot escape buying the insurance or paying the penalty/tax. If I have my money in tax free muni’s, I don’t have to pay income tax. If I stuff my cash into a worn out mattress and do not receive investment income because of that, I do not f#cking pay income tax either. However, I will still be required to buy government mandated insurance or pay the penalty/tax, just for f#cking existing, because I possess the means to do so. So NO it is not an income tax, income is only used as a means of determining whether you pay the tax or get a subsidy.

Under this asinine ruling, Congress could very well require every US Citizen to purchase a Chevy Volt or pay a tax/penalty for not doing so, as long as they based it on income.

Furthermore, this law forces me to participate in Intrastate Commerce by use of the Interstate Commerce Clause since purchasing health insurance across state lines is not allowed.

So don’t tell me that they are levying a direct tax on every US Citizen for just existing, because that is exactly what they are doing. Never before has there been a law or ruling that required you to participate in an activity just because you exist.

Even for a time, I was exempted from paying into FICA because I was contributing to a Civil Service Retirement Plan. But there is no exemption for this, you will either purchase insurance from private institutions that are approved by the govt., or they will penalize you.

That is basically the same as a robber with a pistol giving you the choice of turning over your money or he will shoot you. Yeah, he exempts you from death if you just turn over your cash.

The tax proposed here, on houses worth over $7.5M, would be a direct tax, so the honest justices would strike it down. It would be a tax aimed directly at the Democrat judges’ friends, so they would strike it down too. POA can bluster all he likes, but he has not demonstrated that such a tax could pass.

Comment by Milhouse — 11/15/2012 @ 11:08 pm

Nope, all they would have to do is call it a luxury tax on mansions over 7.5 million and voila, it’s a valid tax. You know make it similar to Luxury Yacht Tax that applied to boats costing only $100,000.00 or over.

http://articles.baltimoresun.com/1993-05-25/news/1993145090_1_luxury-tax-tax-on-boats-boating-industry

It wasn’t ruled unconstitutional, it was only repealed after it had almost destroyed the boat building business and put thousands of people out of work.

peedoffamerican (f5abd0) — 11/16/2012 @ 12:52 am“Huh? You’re just making my point stronger. That’s two ways to avoid it besides buying insurance, which is a third way, so it’s certainly not a tax on merely existing. And how exactly does a religious exemption make it not a tax on income? Religious groups, like all non-profits, are exempt from the income tax too, you know.”

Milhouse – Are you serious? Members of churches are exempt from taxation? When did that go into effect?

Roberts very deliberately avoids calling the penalty an income tax in his opinion and in fact compares it to taxes on gasoline and other things. After saying the individual mandate does not pass muster under the Commerce Clause he searches for a way to find that portion of Obamacare constitutional. He has to ignore the labels Congress put on the provisions of the bill and decides that it falls within the ability of Congress to levy taxes because in substance it looks and smells and uses similar mechanisms to other taxes which the federal government levies, with the notable exception of criminal penalties for noncompliance. In his own section of the opinion where he outlines his reasoning he glosses over the numerous carve outs built into Obamacare for individuals as have you.

daleyrocks (bf33e9) — 11/16/2012 @ 1:03 am“so it’s certainly not a tax on merely existing.”

Milhouse – Not sure why you even raised this point since it wasn’t even part of my comment.

daleyrocks (bf33e9) — 11/16/2012 @ 1:05 amIt wasn’t ruled unconstitutional, it was only repealed after it had almost destroyed the boat building business and put thousands of people out of work.

Which this abortion of a law is already doing. Look at the headlines of all the different companies that are laying off employees or reducing worker hours below thirty per week in order to avoid paying the additional penalty/tax on employers. Not only are they directly taxing citizens for merely existing, they are giving the double whammy by directly penalizing/taxing business for not participating. Oh of course, they allow certain exemptions for having under 50 employees, blah, blah, blah…. Or if you just happen to be one of Preezies cronies/unions/ donors/company’s that have received waivers.

peedoffamerican (f5abd0) — 11/16/2012 @ 1:05 amFace it Milhouse. If you live and breathe, you will participate by purchasing govt approved health insurance or they will penalize/tax your ass if you don’t. Unless you are means qualified to receive a subsidy just like welfare and food stamps.

If that ain’t a penalty/tax for merely existing, then I’m the Queen of England!@

peedoffamerican (f5abd0) — 11/16/2012 @ 1:19 amActually, they’re also taxing businesses for participating. As businesses are no longer free to offer lower cost plans, such as mini-meds that were popular in fast food & other industries with low paid workers.

Now you must offer the ObamaCare approved version of Health Insurance. Which is expensive, far more expensive than most current major medical health insurance plans.

That’s why I am amused by ObamaCare’s official name. The Patient Protection and Affordable Care Act. The only words in that name that are true are “the,” “and,” and “act.”

So they’ve made health insurance more expensive, not less. Businesses that once offered some insurance now have to choose between all or none.

Clearly as you’ve seen in recent days with these businesses announcing lay-offs and cutting back workers hours they’re choosing none. Because they can’t stay in business by choosing all.

Assuming they can afford the lower tax for not providing any health care insurance as opposed to the higher tax for providing health care insurance that meets all the requirements.

Also, it’s not a direct tax on business. It’s a direct tax on a business’ customers. I’m in business and I could no more afford not pass this along to the consumer than any other cost of doing business such as my rent or my electricity bill. I pass my labor costs along now, why wouldn’t I do that after I’m impacted by higher labor costs thanks to ObamaCare.

That’s why I like that Denny’s franchise owner’s idea of not simply raising prices. Just attach an “ObamaCare” surcharge. It’ll piss off people who voted for Obama thinking he was going to give them “free” health care. Ain’t nothing in life free. They are going to pay for ObamaCare, every time they buy something anywhere.

Steve57 (7a880e) — 11/16/2012 @ 1:34 amOne thing that really disgusts me is this. In the mid 80’s, I computed what a single mother with 4 kids was pulling in from govt programs here in Georgia.

I considered the amount of actual dollars they received in cash from welfare, food stamp allotment per individual, WIC, subsidized rent, Habitat House, or section 8 housing, free Medicaid computed to cost of same type of private insurance policy, subsidy for electric and utility bills, free home phone local service, free use of city transportation, etc… It totaled up to be just under $50,000.00 per year in actual tax free income and not having to do one f#cking bit of work for it, unless you consider working the system as work. No telling what she would be pulling in now tax free.

Here’s the really sad part, police and firefighters with 10 years on the force made under $25,000 per year. With two kids they couldn’t even qualify for food stamps. Knew a lot of other people that were working various jobs that pulled in the same amount or a little more that were in the same boat.

Me without children, couldn’t have even sniffed a food stamp without getting bitch-slapped by the govt. But Unca Sam sure had his hand in my pocket and still does. Would see and still do, these welfare queens pull up to the grocery store in their shiny new cars while I drive a 12 year old car. Not gonna sink my ass in debt to buy a new one with the economy about to tank.

One woman with stairsteps following her fatass thru the grocery store, is being checked out and is told that the dog food contained in the two completely filled buggies with all sorts of name brands and meat, is not eligible to be paid for with her food stamps. Woman is pissed and tells clerk to take it off her bill. She then holds up the line by going to the back of the store. She returns with an armload of steaks and hamburger meat and states that the G#D D#mned dog would just have to eat that instead.

And this is what Unca Sam is taxing the pure dee sh!t out of me for? How is that fair in the least? I buy generic brands, and only buy meat when it’s on sale. Her f#cking dog is eating better than what I can afford, because I am being taxed to pay her lazy ass to not work.

peedoffamerican (f5abd0) — 11/16/2012 @ 2:04 amAlso, it’s not a direct tax on business. It’s a direct tax on a business’ customers.

Comment by Steve57 — 11/16/2012 @ 1:34 am

I see that you answered the question that I was about to ask. Who pays 100% of the taxes in this country? It’s not businesses that do. It’s paid for by taxpaying consumers because businesses do not pay tax, they pass it on down to their consumers by increased prices or they are no longer in business. If they don’t pass their costs on to the consumer, the inevitable result is? Yep, bankruptcy and outa business!

Think for one minute about the amount of tax that you pay that’s hidden in consumables of any kind. From FICA taxes, income taxes, excise taxes, fuel taxes, etc…., they are hidden in the cost of the finished product. And then guess what? You are generously allowed by your local and state govt to pay sales tax on all of those hidden taxes! Gee ain’t life just grand!@!!!!

peedoffamerican (f5abd0) — 11/16/2012 @ 2:18 amComment by peedoffamerican — 11/16/2012 @ 2:18 am

And that’s one of the reasons that I go by the handle of peedoffamerican, because of govt refusing to reign in uncontrolled spending and redistributing my taxes to a bunch of lazy ass bums PISSES ME OFF TO NO END!

peedoffamerican (f5abd0) — 11/16/2012 @ 2:25 amTake revenge on the rich land owners who brought the new demographics here to make themselves richer while sticking you with a communist state. You can’t get revenge on the first wave of rich land owners cos they’ve dead for 150 years, but the 2nd wave is still alive.

j curtis (f4a87d) — 11/16/2012 @ 4:21 amCalifornia got started with a gold fever. People found it, others came along. If they couldn’t steal it, they killed for it.

nk (875f57) — 11/16/2012 @ 6:25 amIt’s all about when the default happens – when we will hear about not crying over spilled milk, how we need to focus on the future and not the past, now mistakes were made, and how we are all in this unexpected situation together.

At that time we will all be expected to feel very guilty about how our system failed the people. And most people will continue to love their parasite overlords.

Amphipolis (d3e04f) — 11/16/2012 @ 6:42 amThe trick to that is finding a way to keep giving them goodies.

If the collapse cuts those off, then there will probably be massive and historical violence.

If the collapse comes with socialism, unfortunately a lot of Americans will jump at that even if they see a huge decline in our country (and their own fortunes).

I really do think the most peaceful way to resolve this is for some states to secede. This seems extreme, but we live in extreme times. Let us all take a proportional share of the debt (as unfair as that is) and go our separate ways. If the liberals want a socialist country, they can have it.

Of course, as soon as this happened there would be a flood of sane people into Texas. Which isn’t a long term bad thing.

Dustin (73fead) — 11/16/2012 @ 6:54 amI remember the first time I encountered someone who made more in welfare than I was earning at my job at the time. It didn’t help that I was exhausted from a long day at work. I have a loyal personality and put 100% into my job, even if it’s a stupid job (at the time, I was a waiter but I also was washing the dishes in the back because our lady for that didn’t show up).

The thing that really upset me was that the welfare recipient’s attitude was that I owed her something. Not just the government, but me personally. And everyone else. We have created this underclass of dependent people who are certain they are entitled to things they haven’t earned.

How does a nation undo that?

I know how. Via a painful collapse of our economy, with hard lessons about what it takes to feed your family if you’re on your own (which you essentially should be!).

Does the GOP have the spine to loudly and proudly tell these people we don’t owe them anything?

I don’t see the downside in this approach. I thought Romney’s ‘47%’ comment was a breath of fresh air (too bad he was just preaching to the choir of the moment).

Dustin (73fead) — 11/16/2012 @ 7:05 amIt’s all about when the default happens – when we will hear about not crying over spilled milk, how we need to focus on the future and not the past, now mistakes were made, and how we are all in this unexpected situation together.

At that time we will all be expected to feel very guilty about how our system failed the people. And most people will continue to love their parasite overlords.

So good, it should be repeated. Never let a crisis go to waste.

JD (185efa) — 11/16/2012 @ 7:23 amOn a similar but slightly different topic, I hear Hostess is going out of business because workers went on strike and will not settle for what the company can afford.

No more HoHo’s, in more ways than one.

MD in Philly (3d3f72) — 11/16/2012 @ 7:31 amAt least union officials, if not all of the striking workers, should be penalized in their ability to receive unemployment.

MD in Philly (3d3f72) — 11/16/2012 @ 7:47 am“I hear Hostess is going out of business because workers went on strike and will not settle for what the company can afford.”

MD in Philly – Watch out for a Sno Ball effect.

daleyrocks (bf33e9) — 11/16/2012 @ 8:40 amSigh. This ignorance again. You’re digging yourself in deeper, you ignorant fool. The decision that prompted the 16th amendment was only about income from property. The Supreme Court at that time said that taxing the income property produced is the same as taxing the property itself, because it decreases the property’s value. There was never any suggestion that taxing income itself is a direct tax. There was never any suggestion that taxing wage income, or business income, was in any way improper. The 16th amendment was unnecessary for that. It was only necessary to cover rents and dividends. (And what do you think are the odds that today’s Supreme Court would find the same way? I think today’s court would rule 9-0, or maybe 8-1, that a tax on rents and dividends is indirect, and the entire amendment is superfluous. Do you disagree?!)

In any event, we’re talking about a property tax, which is certainly direct.

Milhouse (15b6fd) — 11/16/2012 @ 10:14 amOn the contrary, the majority decision depends on the assertion that they are not requiring anyone to buy anything. If they were, Roberts wrote that it would be unconstitutional. The decision confirms that Congress has no power to require us to buy things, or to impose a penalty for not doing so. And it says that Congress can’t hide a penalty by calling it a tax, or a tax by calling it a penalty; the court will look at what it is, not at what Congress calls it. You can call this a penalty, and I can call it a penalty, but the Court found that it waddles like a tax, and quacks like a tax, so it’s a tax, and that’s why it’s constitutional; had it been a penalty as Congress claimed it was, it would be unconstitutional.

Sure you can, in exactly the same way. Have no income, or less income than the threshold, and you’re exempt from the tax. Or buy insurance and you’re exempt from the tax.

Since when? Where did you get that from?

No. But they could impose a tax and offer exemptions to anyone who buys a Volt, or who volunteers in a soup kitchen, or who mows the Capitol lawn; so long as the tax could stand alone without exemptions, Congress can offer any exemption that isn’t completely arbitrary. If the tax couldn’t stand without the exemption, and had the clear intent and effect of forcing everyone to seek the exemption, then it would be a penalty no matter what Congress called it, and would be unconstitutional. That’s what the majority opinion says. You can disagree with it, but you can’t dispute that that’s what it says. You can’t attribute to it a position that directly contradicts what it says.

Milhouse (15b6fd) — 11/16/2012 @ 10:39 amThat is in fact an exact parallel; you pay FICA, which is a tax on income, not a penalty, unless you participate in some activity which exempts you, such as an approved retirement plan. In exactly the same way, you pay the 0bamacare tax on your income unless you participate in an approved private insurance plan. You’ve just proved Roberts’s point. FICA doesn’t force you to participate in the Civil Service plan; you could choose not to, and to pay the tax instead. Similarly 0bamacare doesn’t force you to buy insurance; you could choose to pay the tax instead.

One of the proofs Roberts cites for it being a tax rather than a penalty is that the government expects many people to pay it, and budgeted significant revenue from it. Penalties are by their nature designed to raise little or no money, because everyone will comply with the law and not pay them; if a penalty raises significant money then it’s not doing its job and should be raised. In the case he cites where Congress called something a tax but the Court decided it was a penalty, the “tax” was so high that nobody was paying it, and that was one sign that it wasn’t a tax at all.

Milhouse (15b6fd) — 11/16/2012 @ 10:57 amMore ignorance. The yacht tax was an excise on the purchase of new yachts. It was not a property tax. Property taxes are by definition direct taxes, and Congress can’t impose them without apportionment.

Milhouse (15b6fd) — 11/16/2012 @ 11:13 amMembers of churches are not religious groups and are not nonprofits. Churches are religious groups, and since they are nonprofits they are exempt from the income tax.

Milhouse (15b6fd) — 11/16/2012 @ 11:15 amBecause it’s the whole point of this sub-thread, it’s the only reason we’re discussing it in the first place. We were discussing a tax narrowly designed to hit 0bama’s friends and fan club who are clamouring for higher taxes on other people. I pointed out that a property tax wouldn’t be constitutional, and POA started pulling his nonsense lament about how the 0bamacare decision rendered the entire constitution meaningless and Congress can now do whatever it wants to and no law will ever be struck down again from now unto eternity, because taxing our very existence means we’re all slaves, or some such rubbish. Then you chimed in to support POA. If you agree that the 0bamacare tax is not a tax on our mere existence then you disagree with POA, so I wonder what your point was.

Milhouse (15b6fd) — 11/16/2012 @ 11:22 amI have mixed feelings on Church properties being tax exempt…

But I also have issues with government properties/lands being taxed exempt too (in much of the western US, the US government is the largest land “owner”).

In our area (SF Bay Area), so much farm land has been placed into various “green trusts” (private/public entities) that don’t allow people to use the property), that the counties are running out of property to tax.

Federal Lands in the US:

BfC (fd87e7) — 11/16/2012 @ 11:22 amI’m still amazed that POA thinks the “liberal” wing of the Supreme Court would uphold a tax that’s narrowly designed to hit Democrat fat-cats. Or that Democrats in Congress would vote for it in the first place. They know where their bread is buttered.

The luxury yacht excise was targeted at what the Dems at the time thought were R fat cats. The Bushes and their ilk. Yeah, it would hit the Kennedys too, but they’re not the real core of the D elite today. Those people have mansions in California and Aspen, and private planes, but they don’t tend to run to yachts, I don’t think. Except John Kerry.

Milhouse (15b6fd) — 11/16/2012 @ 11:34 amBfC, we’re not talking about local taxes. States and municipalities can and do tax property. But the fedgov can’t.

Milhouse (15b6fd) — 11/16/2012 @ 11:36 amThe Democratics are the tool of the rich:

Obama Wins 8 of the Nation’s 10 Wealthiest Counties

And now that the California Gov/Legislatures do not even need Republicans to show up anymore (super majorities in both houses):

Calif. lawmaker may propose tripling vehicle registration fees

A small home in Nevada with a few acres/well/solar panels–And a mail box to claim Nevada residency and park vehicles there (rotate to California to avoid mandatory registration when needed–keep old car for daily use with cheaper registration) is starting to look cost effective even in this climate.

The Republicans may be the party of the rich–But the Democratics are able to sell the rich on self emulation through crony capitalism and government employment.

Have to research the whole “I am not a resident of California for tax purposes” issue.

BfC (fd87e7) — 11/16/2012 @ 11:44 am“Members of churches are not religious groups and are not nonprofits.”

Milhouse – Exactly. Which is why my comment said “You can avoid it be being a member of certain religious groups” and you countered with an idiotic statement not related to the comment, just like the strawman you raised about:

“so it’s certainly not a tax on merely existing”

Because you believed it was the topic of the subthread although you were specifically addressing a comment of mine in which it was not raised.

If you don’t want people to treat you like a jackass, try not to act like one.

daleyrocks (bf33e9) — 11/16/2012 @ 11:53 amI understand there is no direct Fed property tax–But the “Government” and various “non-profits” are certainly avoiding virtually all of the local taxes (property, fuel, some even avoid Social Security, and push pension charges on to future tax payers, etc…) that are supposed to pay for our infrastructure.

Yes–It sounds crazy to charge property taxes for fire engines and police cars–But there is a societal cost for those things too–As well as placing XX% of property “off limits” to private/commercial uses and taxes.