Obama’s Plan to Tax the Rich: Totally Worthless, Sophomoric, and Cynical

Warren Buffett explained the secret to addressing the challenges facing the United States during President Obama’s first term. In a short commentary written for The New York Times—headline: “Stop Coddling the Super-Rich”—Buffett explained, “My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice.”

President Obama was relatively cautious about taking Buffett’s advice.

Until now.

With an eye toward addressing income inequality, the president will use his State of the Union Address to propose new taxes and fees on very rich people and very big banks. In any historical context, the tax hikes and fees are “modest,” but after a period of absurd austerity and slow-growth economics, Obama’s move is as important as it is necessary.

At a point when there is broadening recognition of the social and economic perils posed by income inequaliy, the president is talking about taking simple steps in the right direction. Congress is unlikely go along with him, but the American people will—Gallup polling finds that 67 percent of likely voters are dissatified with income and wealth distrution in the United States. And as this country prepares for the critical presidential and congressional elections of 2016, the president’s clarifying of the terms of debate on taxes becomes vital.

What utter nonsense. You can’t get out of our deficit problems by taxing the rich. As I said in 2011:

[O]ne of the points I have been making lately is that higher taxes on the rich cannot possibly balance the budget no matter how confiscatory they are. You could return to 2000 levels for incomes over $200,000, raise the top rate to 50% for those making $500,000, 60% for those making over $5 million, and a sky-high 70% for those making over $10 million, and you know what you would raise? An extra $133 billion per year, in a budget whose deficits are more than 10 times that amount.

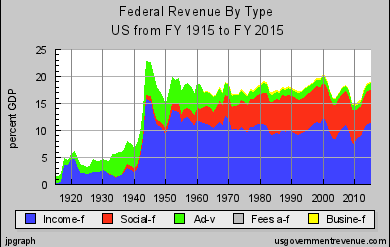

I have also made the point that increases in taxes, even giant ones, don’t do much to increase revenue:

[W]hether the top tax rate is 90% as it was in 1960, or 30-40% as it’s been since 1990, federal revenue is always 15-20% of GDP:

The whole “income inequality” canard has been addressed here before. Our Savior Mitt Romney thinks its a problem, as I noted here. But it’s not. The free market is the best thing that ever happened to poor people, which is in large part a testament to the consumer surplus. Interfere with the workings of the free market, and you approach communism: that wonderful state where everyone is the same, namely, equally poor. (In actuality, not everyone is the same; party members get special treatment and black markets flourish. But never mind all that!) As Margaret Thatcher said (and I noted in this post): “What the honorable member is saying, is that he would rather the poor were poorer, provided the rich were less rich. . . . Yes, he would rather have the poor poorer, provided the rich were less rich.”

That’s what Obama wants. Never mind that the free market is the best thing in the world for poor people. He wants to end it, and he’ll bend the rules to do so.

P.S. I’ve been reading lately about the fall of the Roman Republic, and it seems eerily reminiscent of Obama’s actions lately. But that’s another post.

We can’t get rid of this guy quick enough.

UPDATE: Since some people don’t get it yet, let me quote this post of mine from 2013 (already linked above):

First, even confiscating all millionaires’ taxable income would not close the gap. It’s difficult to find recent statistics for these numbers, but in posts I wrote in April 2011 I quoted people who had examined IRS statistics and found that in 2008, “Taxable income over $100,000 was $1,582 billion, over $200,000 was $1,185 billion, over $500,000 was $820 billion, over $1 million was $616 billion, over $2 million was $460 billion, over $5 million was $302 billion, and over $10 million was $212 billion.” To get that $1.3 trillion you can’t close the gap by taxing rich people. You could confiscate all the income of people with taxable income over $1 million and it would not close the gap by half.

Of course, that assumes that people with a 100% tax rate would happily continue to work just as hard as they had when they got to keep some of their money. If you believe that, you’re an idiot.

Ding.

Patterico (9c670f) — 1/19/2015 @ 12:20 amIt’s all a canard designed to elect Warren. Obama knows none of what he proposes will pass, so why not propose candy canes and unicorn farts? Warren can assail the GOP for not passing “common sense income reform” and play the populist all the way to the White House.

I give up asking the public to attempt to understand economics. If it isn’t something you can tweet, they don’t care. We deserve where all this leads us.

bob (a62c97) — 1/19/2015 @ 2:41 amThe crazy thing about the “Tax the Rich” plan is that every time it has been tried either here or abroad, the expected increased tax revenues never appeared. In one instance, the CBO predicted a 100% increase in revenue but the actual result was an almost 35% decrease in revenue. Pixie dust & unicorn farts indeed! As Einstein is reputed to have said “Repeating an experiment and expecting a different result is a sign of insanity,” I would beg to add “or Liberalism.”

Michael M. Keohane (a62dc7) — 1/19/2015 @ 3:47 amAh, they should just go ahead and pass a bill titled “The George Soros, Bill Gates, Warren Buffet and Major Democrat Donors Net Worth Confiscation Bill” which will cap wealth of Democrat donors at, say, 1 billion. Even Michelle Obama likely could live on that.

cedars rebellion (cb76fc) — 1/19/2015 @ 5:17 amThe repub candidate that can succeed in making the point to the public has the pole position.

I think someone should call out Warren Buffett, if he wants to pay more taxes, nothing is stopping him. If he thinks it is a good thing, let him set the example.

MD in Philly (f9371b) — 1/19/2015 @ 6:07 amBuffet has played this administration like a violin. Who do you think the principal beneficiary of the ban on the XL pipeline is ?

I think Bill Gates is sincere but has the typical mentality of the computer nerd. I was once an engineer and they are not the most savvy bunch about economics.

Soros made his money attacking the British pound and has continued to make billions as a currency speculator.

With the trade on since November, Soros Fund Management made a reported $1 billion profit to open a year in which he personally earned an estimated $4 billion, landing him atop our list of highest earning hedge fund managers.

Who are the loyal Obama supporters among the rich ? Currency traders and hedge fund managers. Why ? Guess.

Mike K (90dfdc) — 1/19/2015 @ 6:24 ambob @2.

And NOT Hillary Clinton.

Could be.

Sammy Finkelman (e806a6) — 1/19/2015 @ 6:25 am3. Michael M. Keohane (a62dc7) — 1/19/2015 @ 3:47 am

In Washington, it doesn’t matter what actually happens; what matters is whatteh Congressional Budget Office says will happen.

And that’s true also for Republicans, who, at most, want too change what the CBO says. And not necessarily to what will turn out to be correct.

Sammy Finkelman (e806a6) — 1/19/2015 @ 6:29 amOrrin Hatch says these “tax increases” are more accurately described as user fee adjustments.

I don’t know why you people have to be so tendentious.

happyfeet (831175) — 1/19/2015 @ 6:29 amMike K (90dfdc) — 1/19/2015 @ 6:24 am

Since they borrow lots of money, but make money in other ways than simple lending it out, they are among the people for whom low interest rates are valuable.

Also, what matters to them is not so much how well the economy is doing, but being able to predict what’s going to happen. Knowing a few things, here and there.

And some relatively obscure taxation rules matter. Also, the details of other rules.

And new forms of speculation are useful. Cap and trade!!

They are not really that affected by general economic trends.

Sammy Finkelman (e806a6) — 1/19/2015 @ 6:40 amWhen the world is running down

Colonel Haiku (2601c0) — 1/19/2015 @ 6:53 amhe’ll fleece the “rich” who’re still around

This is what much of the world is reading about. It’s Davos time and there will be many many headlines and charts. Are Oxfam’s figures correct? IDK. But you will see them everywhere:

http://www.theguardian.com/business/2015/jan/19/global-wealth-oxfam-inequality-davos-economic-summit-switzerland

Unfortunately, most economically unsophisticated people in the United States cannot discern the true distinction between the world’s mega-super-rich multi billionaires of Davos, and the “rich folks” in the next suburb over whose cars and houses are a little bigger than theirs. This is why Patterico’s accurate free market argument with respect to Obama’s SOTU proposal to tax the rich, is not an easy one to get heard amid the global noise.

elissa (65cb15) — 1/19/2015 @ 7:08 amFrom this study a decade ago Americans make up approximately half of the world’s richest 1%.

That must make Obama crazy. And, yes, Fauxchahontas is standing right behind him.

http://money.cnn.com/2012/01/04/news/economy/world_richest/

elissa (65cb15) — 1/19/2015 @ 7:19 amUnadulterated horsesh*t.

DNF (831ee5) — 1/19/2015 @ 7:25 amhttp://www.nydailynews.com/news/national/obama-rally-middle-class-union-address-article-1.2083527

Sammy Finkelman (e806a6) — 1/19/2015 @ 7:29 amIn proposing to tax the most productive people in America, President Obama is proposing to raise taxes on those who are least likely to vote for Democrats. The only question is whether these proposals energize the Democratic base — the least productive people — more than it costs them, on the margin — votes remaining from the more productive people that they still get.

The economist Dana (f6a568) — 1/19/2015 @ 7:53 amP.S. I’ve been reading lately about the fall of the Roman Republic, and it seems eerily reminiscent of Obama’s actions lately. But that’s another post.

It’s certainly a variation of what both Herbert Hoover and Franklin Roosevelt did in the early 1930s, when their answer to the Great Stock Market Crash of 1929 and ensuing Great Depression was to hugely ratchet up income taxes, particularly on wealthier Americans.

The stupidity of not understanding how that placed an even bigger chill on people who create more socio-economic synergy by investing in new or existing businesses is breathtaking. Even supposed leading economists couldn’t figure that one out, which absolutely astounds me.

Mark (c160ec) — 1/19/2015 @ 8:01 amWhen you accept that to them it’s always and only about income and wealth redistribution you basically have all the understanding that is required.

elissa (65cb15) — 1/19/2015 @ 8:10 amThe focus on “wealth” as opposed to “income” is not a trivial distinction. In much of the third world there is no rule of law as we understand it. I’ve heard that in Egypt one of the things that is holding them back economically is that real property is not owned by those who occupy it. They cannot use the property as collateral. So this “wealth” is not theirs, even though they act like they owned it. In Mexico, foreigners used to be/are(?) prevented from owning land and so it is necessary to find intermediaries like Mr. Gomez to build your dream house in Baja. This might sound like a good thing, but I’ll bet you not every Mexican property owner is as proactive as Gomez, and so they sell their property at a value that is much less than they’d get if they had an open market for it. We have something like this in the cities that have “rent control”. Those who occupy these “controlled” appartments spend small fortunes upgrading them knowing that they will be protected from eviction by the local political machine. They can’t use this “investment” as collateral, and the land lord is stuck with a turkey that he can’t use as collateral. So this wealth is locked up and unavailable for investment in other activities that could benefit everyone. The real beneficiary in this deal is the political machine because this gives them some very motivated clients.

It is also the case that Oxfam is really all about exploiting envy and resentment. A poor family in many third world countries has some access to health and educational resources that are incomparably better than royalty three centuries ago. If they care to ask, they can even learn that the earth revolves around the sun and not vice versa. They have access to intellectual tools that could revolutionize their lives, which is the premise for the Peace Corps. It is the lack of “wealth” that is holding them back. The cause of this problem is not wealth held in other places, it is the structure of their own government and likely their religion that makes their fate dismal. And being unable to acquire “wealth”, life in these hell holes devolves into who you know and what do you need to do to keep your more powerful patrons happy. It is not slavery exactly, but those who complain of “wage slavery” haven’t really considered the alternatives as they are practiced in the third world.

bobathome (f208b6) — 1/19/2015 @ 8:10 amWithout our government first acknowledging, admitting and owning the fact that we do indeed have a spending problem, little will change. And they cannot afford to ever give voice to that.

Taxing the most productive people in the country will only cause the least productive people in the country to remain in the position they find themselves in. And by taxing the most productive, there is not much incentive for the least productive to change their situation – because they don’t have to. They will continue to be provided for by the taxpayer. Being given free stuff and having others pay your way (now a multi-generational way of life for many) has been utterly destructive to our collective economic good. I think that’s why free-market messaging is so difficult to not only be heard, but believed and received. The Democrats certainly don’t want anyone to understand it because they risk the chance of losing voters they rely upon, and those on the receiving end of the handouts certainly don’t want to see things change either as that would mean the assistance would diminish and they would be compelled to have to make changes. And although they would benefit from that in the long run, it’s a short-run life most lead. So break others’ piggybanks and shspread the wealth.

Dana (8e74ce) — 1/19/2015 @ 8:22 amMitt Romney will explain to failmericans why these proposals are bad and the president will just have to withdraw them

you’ll see

happyfeet (831175) — 1/19/2015 @ 8:25 amThis comment could not possibly be more off topic, so I apologize in advance. But, for any Deadheads out there, they are reuniting (with a special guest member) in Chicago for three farewell concerts in July.

http://www.billboard.com/articles/news/6443522/grateful-dead-reunion-shows-trey-anastasio-chicago-anniversaryU

elissa (65cb15) — 1/19/2015 @ 8:26 ama co-worker wants to buy her bf tickets for vd

but she’s hoping he takes someone else

happyfeet (831175) — 1/19/2015 @ 8:27 amif that billboard link doesn’t work for you, you can get it direct from google where it does.

elissa (65cb15) — 1/19/2015 @ 8:32 amInterestingly, Charles Blow writes about the difficulty of being poor today. I’m guessing that Blow is also on the same page with John Nichols.

Dana (8e74ce) — 1/19/2015 @ 8:37 am17 – The economist Dana –

mg (31009b) — 1/19/2015 @ 8:42 amThat’s a colorful way to approach it!

Unfortunately, mg, it’s actually a sad way to approach it.

The sadly realistic Dana (f6a568) — 1/19/2015 @ 8:50 amFrom Jazz Shaw:

A positive message of hope and aspiration and being able to achieve “the American dream” for oneself has worked in the past, Shaw reminds, to counter the wealth imbalance. But the worse off the middle class gets and stays the harder it is for them to believe they can actually make it.

http://hotair.com/archives/2015/01/19/how-does-the-gop-fight-a-populist-tax-the-rich-proposal/

elissa (65cb15) — 1/19/2015 @ 9:28 amSince we’re discussing tomorrow’s taxapalooza speech, this may be an appropriate question to ask here.

A key point in the Roberts abortion of a ruling when he twisted the individual mandate into a tax instead of a penalty is contained here:

http://www.washingtonpost.com/blogs/the-fix/post/supreme-court-health-care-decision-full-text/2012/06/28/gJQAueJ88V_blog.html

Now we’re seeing tons of articles like this:

This is just the first year. The penalty doubles in the second year, and rises to 2.5% of income in it’s third year. If Roberts in his pretzel logic had to claim the “tax” isn’t a penalty because it doesn’t compel people to buy insurance, but it is in fact so high it forces people to buy insurance, at that point does anyone have standing to sue on the grounds the SCOTUS was completely wrong on the facts?

Steve57 (2baf2d) — 1/19/2015 @ 9:39 amThis is beyond cynical. Never mind that it won’t pass, it wouldn’t raise much money if it did.

Capital gains, for the already rich, are optional income. Usually they take cap gains only to balance out losers they have dumped, since they cannot write off capital losses directly. But appreciating assets are seldom sold. If they need money they can borrow against them without being taxed, and often write off the interest. The only time these assets are taxed is if they die and have not sheltered them from death taxes (which would be unusual).

So, upping the rate on cap gains for those making over $500K only really hits middle-class people with once-in-a-lifetime windfalls: sale of a greatly-appreciated house by the elderly; cashing in of founder’s stock after a sucessful startup (not everything is Facebook); or a lucky stock market bet (e.g. buying Amazon at $7 in 2002).

None of these are soaking the rich so much as stomping down on upward mobility. Something the Democrats truly fear.

Kevin M (25bbee) — 1/19/2015 @ 9:39 amIf Roberts in his pretzel logic had to claim the “tax” isn’t a penalty because it doesn’t compel people to buy insurance,

A wise man once said “The Supreme Court reads the election results.”

Kevin M, correct in every way.

Mike K (90dfdc) — 1/19/2015 @ 9:55 amI like this…

Six Conundrums

Colonel Haiku (2601c0) — 1/19/2015 @ 9:57 am“The word conundrum is defined as a complex problem that is often puzzling or confusing. Here are six conundrums of our contemporary United States of America:

1. America is capitalist and greedy – yet almost half of the population is subsidized.

2. Half of the population is subsidized – yet they think they are victims.

3. They think they are victims – yet their representatives run the government.

4. Their representatives run the government – yet the poor keep getting poorer.

5. The poor keep getting poorer – yet they have things that people in other countries only dream about.

6. They have things that people in other countries only dream about – yet politicians (mostly progressive socialists) claim they want America to become more like those other countries.”

http://www.peekinthewell.net/blog/six-conundrums/

Colonel Haiku (2601c0) — 1/19/2015 @ 9:58 amWe really dodged a bullet by not electing Romney in 2012.

daleyrocks (bf33e9) — 1/19/2015 @ 10:09 amThere you go again, daley…

Colonel Haiku (2601c0) — 1/19/2015 @ 10:12 amThe question to ask is “Why do Democrats want to tax upward mobility?”

Kevin M (25bbee) — 1/19/2015 @ 10:15 amSome nit comments.

Taxes by themselves are not necessarily detractors from a free market, since in this case we are talking about the taxes that derive from the income from a free market. I think you should better link what government does with those taxes as that has a significant affect on “free” markets.

Two – i would suggest that inequality is actually a very much societal “bad (negative good?)” today as apposed to say 100 years ago. The reason is the source of inequality. Too much inequality today is the result of really blatant rent seeking behavior. People see this. They understand it for what it is.

Regards

Jeffrey (2eddb6) — 1/19/2015 @ 10:31 amFirst, if “spending” is the real problem, doesn’t it make sense that the only way spending will be reduced is if the taxpayers are actually forced to pay for the spending? If it gets to be too much, then people will demand lower spending in order to reduce taxes. Keeping taxes low if spending remains high doesn’t do anything but push fiscal problems down the road.

Second, I don’t understand the point of the original post – if tax increases could produce an additional $133 billion for the government, that would reduce the current deficit (not the one in 2011) by more than 25%. Why isn’t that meaningful? (If $133 billion isn’t sufficient to get your attention, I’ll keep that in mind next time you propose eliminating spending of less than that amount.)

Finally, if federal revenue is always between 15-20% of GDP, doesn’t it make sense to keep it closer to 20% in order to reduce the deficits? After all, 20% of GDP is 33% more than 15% of GDP.

Jonny Scrum-half (b8f5ef) — 1/19/2015 @ 10:36 amI agree about rent seeking and the Democrats are experts. Taxing does alter behavior and Obama doesn’t care. Even Charlie Gibson knows that raising capital gains taxes lowers revenue.

Well, Charlie, what I’ve said is that I would look at raising the capital gains tax for purposes of fairness.

We saw an article today which showed that the top 50 hedge fund managers made $29 billion last year — $29 billion for 50 individuals. And part of what has happened is that those who are able to work the stock market and amass huge fortunes on capital gains are paying a lower tax rate than their secretaries. That’s not fair.

They knew he was lying and they all supported him for election twice.

Mike K (90dfdc) — 1/19/2015 @ 10:37 amif tax increases could produce an additional $133 billion for the government,

As our host might say, “That assumes facts not in evidence.” That should answer a lot of questions from other commenters about economic ignorance, though. Thanks.

Mike K (90dfdc) — 1/19/2015 @ 10:38 amI thank you for recommending Dr. Sowell’s A CONFLICT OF VISIONS; my, my … unconstrained vs. constrained visions and I am reeling. I recommend a book that references a number of civilizations including the Roman Empire: THE COLLAPSE OF COMPLEX SOCIETIES by Joseph A. Tainter.

…there are a number of economists who, despite the reputation of their discipline for pessimism, believe that we face, not real resource shortages, only solvable economic dilemmas. They assume that with enough economic motivation, human ingenuity can overcome all obstacles…In the contrary view, espoused by many environmental advocates, current well-being is bought at the expense of future generations…Both views are held by well-meaning persons (!) who have intelligently studied the matter and reached opposite conclusions. BOTH APPROACHES, THOUGH, SUFFER FROM THE SAME FLAW: KEY HISTORICAL FACTORS HAVE BEEN LEFT OUT.

Just for thought: ” Arrogant (eloquent) lips are unsuited to a fool — how much worse lying lips to a ruler.” Proverbs 17:7 And the note: “His right to rule depends on honesty and justice.” I believe we are a nation that has forgotten God (abandoned law and embraced lawlessness) and we are definitely looking at collapse. BTW Tainter disavows the “mystical” … sort of.

Karen Ferris (1a77e4) — 1/19/2015 @ 10:43 amSorry, thought I had that quote set correctly … oh, well.

Karen Ferris (1a77e4) — 1/19/2015 @ 10:45 am20. bobathome (f208b6) — 1/19/2015 @ 8:10 am

The focus is on wealth, but the tax proposals are on income. Nor is there any effort usually to try to affect pre-tax income in some way.

Hernando de Soto wrote about that in several books. He was thinking mainly of Peru, or Latin America.

Of course this happens because a lot of people are squatters and do not actually own their land.

Their presence is tolerated most of the time, but not to the extent they can borrow on that land, or risk improving it too much.

Theer are people who argue it isn’t so simple, and I think you could agree because there are not really secure property rights in China, and yet the economy grew. Of course, things depend upon connections.

Sammy Finkelman (e806a6) — 1/19/2015 @ 10:50 amSteve57 (2baf2d) — 1/19/2015 @ 9:39 am

I don’t know, but in reality it isn’t so high.

It would force everyone if you found in fact that everybody bought it, but they won’t, because the penalty will still be cheaper than the insurance.

And also payment can be delayed if someone avoids having an income tax refund due for ten years. And Congress will probably take care of it anyway before that.

Democrats want to forgive student loans, and Republicans will want to forgive the Obamacare penaty but probably only if it hasn’t yet been collected. That’s the way to bet.

Sammy Finkelman (e806a6) — 1/19/2015 @ 10:56 amIt becomes not a tax when nobody owes the tax.

Sammy Finkelman (e806a6) — 1/19/2015 @ 10:58 amMike K @41 – Argue with Patterico; he’s the one who wrote about raising an additional $133 billion by raising taxes.

Jonny Scrum-half (b8f5ef) — 1/19/2015 @ 11:02 amA Capital Gains increase from 20% to 28%!

askeptic (efcf22) — 1/19/2015 @ 11:12 amAll you Middle Class CA homeowners in the Coastal Belt are going to really benefit from that when you sell your home to escape to Free America, because let’s face it, the exemption amounts to croissant-money in CA’s real-estate market.

You vote Progressive, this is Progress for YOU!

Mr. Jeffrey if you take hundred of billions of dollars out of private hands and give it to a fascist freedom-hating scumstate like failmerica, you’re subsidizing unfreedom at the cost of freedom

and it’s bad

happyfeet (831175) — 1/19/2015 @ 11:19 ami did not know there were that many conundrums Mr. Colonel

happyfeet (831175) — 1/19/2015 @ 11:20 amAccording to the LSM, the plan raises $320B over the next decade.

askeptic (efcf22) — 1/19/2015 @ 11:22 amMG, $32B/yr in DC is just barely a rounding error.

This is all about politics, and has nothing to do with economics, or fiscal responsibility.

speaking of economizings i share with you the secret

you can get alessi coffee pods now for your nespresso machine!

they come out to about 65 cents a pod compare to the $1.10 nespresso wants (and this was before the swiss franc got turned out like a thai tranny hooker)

you don’t necessarily have to get them online btw I found them at Jewell

you are welcome please to enjoy

happyfeet (831175) — 1/19/2015 @ 11:33 amJonny Scrum-half:

You are overlooking the sky-high percentage increases we are talking about to raise that relative pittance. And all this assumes that people don’t change their behavior in response, which they do (the point of the next argument in the post). Let me put it more starkly: you could confiscate all of the income of those making over a million dollars a year and still not solve the problem. Get it now?

Patterico (9c670f) — 1/19/2015 @ 11:39 amHere’s an update with the numbers:

UPDATE: Since some people don’t get it yet, let me quote this post of mine from 2013 (already linked above):

Of course, that assumes that people with a 100% tax rate would happily continue to work just as hard as they had when they got to keep some of their money. If you believe that, you’re an idiot.

Patterico (9c670f) — 1/19/2015 @ 11:44 am*Jewel* I mean

you really have to look

it’s the only nespresso one in a sea of K-cup ones

happyfeet (831175) — 1/19/2015 @ 11:47 amhttp://www.wsj.com/articles/obama-to-propose-tax-hikes-on-investments-inherited-property-1421542876

So, that’s a net revenue increase, according to sure-to-be-wrong projections, of $85 billion, summed up over 10 years, so an average of about $9 billion a year. Even gross $32 billion.

Sammy Finkelman (e806a6) — 1/19/2015 @ 12:04 pmMaybe the terms and conditions here should be changed:

http://www.nytimes.com/2015/01/08/us/iraq-veteran-now-a-west-point-professor-seeks-to-rein-in-disability-pay.html

http://www.nytimes.com/2015/01/15/opinion/is-disability-pay-hampering-veterans-future.html?_r=0

It probably actually would cost some more.

Sammy Finkelman (e806a6) — 1/19/2015 @ 12:15 pmThat’s a lot of Sturm und Drang for a measly $9B.

askeptic (efcf22) — 1/19/2015 @ 12:16 pmBut, stirring the ‘stuff’ pot is the SOP for Community Organizers.

“First, if “spending” is the real problem, doesn’t it make sense that the only way spending will be reduced is if the taxpayers are actually forced to pay for the spending?”

Jonny Scrum-half – It’s not a problem for the 40% who currently don’t pay any federal income tax. We have the most progressive effective income tax system in the world, with the top 1% paying 39% of all federal income taxes.

daleyrocks (bf33e9) — 1/19/2015 @ 1:37 pm28-The sadly realistic Dana-

mg (31009b) — 1/19/2015 @ 2:38 pmI agree it is sad. It appears everything has to do with color for Sotero.

I think his plan is racist. I should have just said it.

Jonny Scrum-half … The day I broke my ankle, Serg, our scrum-half, was carted off to the infirmary bleeding from the ears and the nose from a kick by our opponent’s prop. We met up at the infirmary, but he was kept for observation. I returned to the match in time to see us prevail despite playing 13 versus 15. Ah, the good old days. Serg ended up recovering and was one of the lesser authors who first explained continental drift. I crashed into his VW while driving to school about a year later with my right wrist in a cast, courtesy Dartmouth, whom we also defeated. Could it be that being kicked in the temple is an occupational hazard for scrum-halfs?

bobathome (f208b6) — 1/19/2015 @ 5:59 pmSammy, I’m pleased to see that you are beginning to read between the lines. My point was indeed that the media’s “outrage” is directed at wealth, while the remedy they support is directed at “income”.

bobathome (f208b6) — 1/19/2015 @ 6:01 pmAs Patterico points out, high taxes on income may disincentivize people to earn high incomes. The solution is taxes on net worth. I would start at a $1 billion breakpoint with a 5% tax on that first billion, 10% on the next billion, 15% on the one after that etc., going up 5% more for each additional billion with no cap even if it means that Warren Buffet has to pay 200% tax on his 200th billion. Now that’s good taxation strategy. You see, you go after what’s there now. You don’t wait for the mopes to earn it. Bird in the hand.

nk (dbc370) — 1/19/2015 @ 6:13 pm“Bird in the hand..” This would be the death knell for America. You are undermining the right to own something. The birds you are mishandling would find their wings and end up somewhere else. Singapore would be my choice (if I was so fortunate as to fall into one of your wealth brackets.) And it would not be long before those with wealth decided that it would be wise to spend 20% of what’s left in corrupting the agents of Robin Hood. Five years of this benighted policy, and Obola would start to look good. But only in comparison to what was left of America. You might as well move to Istanbul right now if this seems like a good idea.

The rule of law and the right to own property was a really big innovation in human affairs. The dark ages would descend quickly upon the world if we are so stupid as to ignore this.

bobathome (f208b6) — 1/19/2015 @ 6:32 pmYou presuppose that their presence in America is of benefit to anyone other than themselves. Very few people are worth the money the super-rich have. Bill Gates is probably the only in the last hundered years, with the Wright Brothers before him (and they did not get super-rich). The Vanderbilt, the Carnegie, the Rockefeller, the Buffet, the Soros ilk, definitely not.

nk (dbc370) — 1/19/2015 @ 6:46 pmAndrew Carnegie financed libraries in even the tiniest towns across America. I cannot tell you the number of hours I spent in our town’s Carnegie library and the thousands of books I checked out and read from it.

elissa (a21bd1) — 1/19/2015 @ 6:53 pmCrumbs that fall off the table. So he won’t be remembered as a greedy penny-pincher. Now if you said the American steel mills are what won WWII, you’d have me.

nk (dbc370) — 1/19/2015 @ 6:56 pmForgot 😉

nk (dbc370) — 1/19/2015 @ 6:56 pmIndeed, Carnegie libraries all over,

MD in Philly (f9371b) — 1/19/2015 @ 7:36 pmsome would say it would have been real nice for more of that money to go to the coal miners who helped earn it,

but I admit my sources are a bit biased,

so I don’t know exactly what the facts were.

I think I remember reading that he made it a point to live on “only” $50,000 a year,

which was a lot of money back then.

May I ponder a question here? And I am truly hoping that those smarter than I will take it up. My conservative ideals agree with everything in your post, but I have a nagging concern. I have no problem with the rich being rich, the super rich being super rich, even with those who can claim filthy rich status. In short, good for them, and likely by what they do with that money, good for the rest of us, too.

This system by its nature creates an imbalance. My ONLY concern is do we know how much imbalance can be tolerated, and what to do to maintain the system if it is deemed that a tipping point is nearby while preserving conservative principles?

How much of a nation’s wealth can be controlled by the top, very narrow few. 10%? 20%? 40%? 80%? I’d say that top number is too large. Ay agreement on this? What if it heads in that direction? How do we save the building without undermining its foundation?

Any thoughts? I would really love to know of any good reading into this topic-

NeoCon_1 (324e03) — 1/19/2015 @ 7:59 pmBbbbut — surely all right-thinking people EVERYWHERE must grasp the stunning brilliance of Dear Leader’s proposal:

YES, WE CAN TAX OURSELVES INTO ECONOMIC HEALTH.

It should only take a couple of years — 5 at most!! If we tax EVERYBODY at 250% ===> Government (“another name for the things we choose to do together”, you know) will be able to fund EVERYTHING for EVERYBODY!!! (Yes, a little temporary belt-tightening might be required, but ask Buffett — it’ll be a small price to pay!)

A_Nonny_Mouse (51787d) — 1/19/2015 @ 8:23 pmMr M wrote:

Because the Democrats’ base believe that there is no upward mobility for them, and hope to persuade the few left amongst the undecideds that there’s no upward mobility for them, either, that all upward mobility has been seized by the Greedy Capitalist Rich™.

And, in a way, they are right: of course there’s no upward mobility for people who suckle the welfare teat, and won’t work!

The Occupier Dana (f6a568) — 1/20/2015 @ 5:34 amSheldon Silver was indicted! Yesterday the accusations were not clear – it seems now the argument is that he took kickbacks, because he didn’t perform any legal services for two law firms. I didn’t know lawyers actually had to do any real work to get paid, if they were a partner in a law firm. That will be his defense.

Sammy Finkelman (d22d64) — 1/22/2015 @ 3:23 pm