Krugman: Debt Crisis? What Debt Crisis?

It’s official: there is no debt problem. Paul Krugman says so — so it must be true:

[D]ebt and deficits have faded from the news. And there’s a good reason for that disappearing act: The whole thing turns out to have been a false alarm.

I’m not sure whether most readers realize just how thoroughly the great fiscal panic has fizzled — and the deficit scolds are, of course, still scolding. They’re even trying to spin the latest long-term projections from the Congressional Budget Office — which are distinctly non-alarming — as somehow a confirmation of their earlier scare tactics. So this seems like a good time to offer an update on the debt disaster that wasn’t.

About those projections: The budget office predicts that this year’s federal deficit will be just 2.8 percent of G.D.P., down from 9.8 percent in 2009.

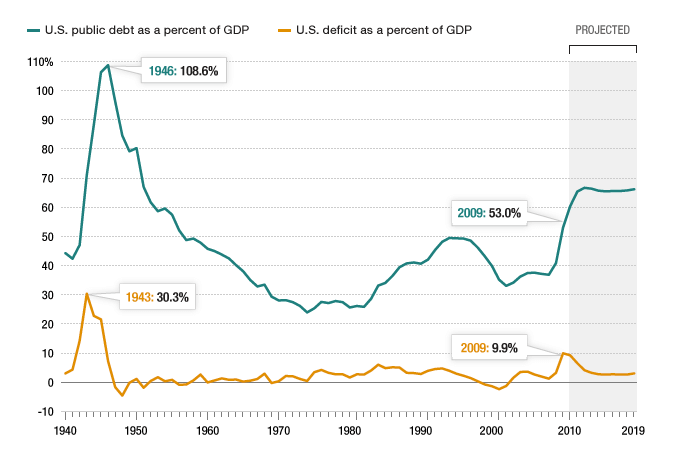

You see the trick, right? He’s using 2009 as our baseline. But 2009, the Year of Our Stimulus, produced the worst deficit-to-GDP ratio since the late 1940s. This chart, produced in 2010, shows the historical perspective. Look at the yellow line at the bottom; that’s the deficit-to-GDP ratio. See how it spikes up in 2009?

More Krugman:

It’s true that the fact that we’re still running a deficit means federal debt in dollar terms continues to grow — but the economy is growing too, so the budget office expects the crucial ratio of debt to G.D.P. to remain more or less flat for the next decade.

The economy is growing? Well . . . if we are using GDP as our measure (and Krugman does), Q1 was actually a contraction of a percentage point. But let’s return to the big picture as explicated by Krugman:

Things are expected to deteriorate after that, mainly because of the impact of an aging population on Medicare and Social Security. But there has been a dramatic slowdown in the growth of health care costs, which used to play a big role in frightening budget scenarios. As a result, despite aging, debt in 2039 — a quarter-century from now! — is projected to be no higher, as a percentage of G.D.P., than the debt America had at the end of World War II, or that Britain had for much of the 20th century.

See? Debt to GDP is no worse than just after World War II! Once again, of course, Krugman is playing with the numbers, as you can see by consulting the handy chart above again. This time, look at the green line on top. See the hugely monstrous spike in 1946? The total outlier, caused by years of destructive world war? The economic disaster caused by the crippling of an economy that spent four years without millions of its most productive citizens? We’re headed back there, on the natural . . . with no world war to explain the tremendous rise in the debt-to-GDP level. And nothing to stop us from breaking through the disastrous WWII levels.

(Note how the trough of that graph was 1971, when we finally went off the gold standard for good. That’s when we began our inexorable addition to the mountain of debt.)

Reassured yet? Oh, but Krugman says the problem is easily fixed:

Still, rising debt isn’t good. So what would it take to avoid any rise in the debt ratio? Surprisingly little. The budget office estimates that stabilizing the ratio of debt to G.D.P. at its current level would require spending cuts and/or tax hikes of 1.2 percent of G.D.P. if we started now, or 1.5 percent of G.D.P. if we waited until 2020. Politically, that would be hard given total Republican opposition to anything a Democratic president might propose, but in economic terms it would be no big deal, and wouldn’t require any fundamental change in our major social programs.

Love how the only possible roadblock might come from Republicans. Let’s be honest: he’s not really talking about spending cuts, or he would talk about Democrat intransigence too. Anyway, Krugman again cooks the numbers by expressing these tax increases or spending cuts in terms of a percentage of GDP. What are these piddling numbers in reality?

1.5% of GDP ($15.68 trillion) is $235 billion. That’s the tax hike or spending cut that Krugman says would be no problem. Yet the sequestration “cuts” (actually reductions in increases in spending) were only $85 billion off the hoped-for increases — about 1/3 of that $235 billion number. And Krugman wailed that they would cost us 700,000 jobs and that we needed to spend more.

The problem that Krugman “forgets” to confront is that, historically, no matter how high you raise that top rate, you never get federal revenue much above 20% of GDP. I have discussed that here before. Even with a top income tax rate of 90%, you still get 20% of GDP as revenue — because people change their behavior as you raise the top rate.

So we need to do it through cuts — and Krugman told us that a mere 1/3 the cuts he says are required were far too damaging to actually implement.

So you can pretend the numbers are small, and shrug off the political difficulties — but you are contributing to the situation and helping ensure it will never be fixed, Krugman.

So yes, we’re still headed towards the cliff. Clip and save Krugman’s column; it’s a keeper. Like his early 2000s call for a housing bubble, it will make fun reading sometime in our bleak future.

Those deficit hawks living in krugman’s mind are really evil people.

joe (debac0) — 7/21/2014 @ 8:52 amKrugman is a Democrat polemicist, not an economist any longer. Private sector entities make spending cuts of the magnitude Krugman describes all the time. There is no reason the public sector cannot. People like Krugman in their academic and opinion column roles as well as many public sector employees do not treat each dollar spent as if it is their own, there is usually more available and it comes from somebody else. I believe they would have learned much different lessons in the private sector but instead spent their entire careers in academia or government service with no accountability.

daleyrocks (bf33e9) — 7/21/2014 @ 9:11 amThose figures for the debt to gdp ratio require some qualification. They are figures for the debt held by the public at large. Usually, a certain portion (~25%) is held by the central bank. That portion has been elevated in recent years as the Fed has expanded the monetary base. If your annual deficit much exceeds 4.5% of domestic product, your relative debt burden is on an upward trajectory. Servicing costs are currently depressed due to the situation with interest rates. Would not count of that continuing.

The thing is, the increase in the nominal value of the federal debt between 1953 and 2008 should have been in the neighborhood of zero. There was no general mobilization and no banking crisis to generate a mass of long term borrowing. There should not have been a problem balancing the budget over the course of the business cycle. It was only after 1960 that it was routine to run deficits absent a business recession, persistent production below capacity, banking crisis, or general mobilization and the Eisenhower Administration turned in three balanced budgets of the four years it might have been feasible. After 1969, the size of these deficits from lack of discipline grew much larger, going from perhaps 1% of domestic product to perhaps 2.5% on average.

Krugman would likely not care to acknowledge that federal projects and agencies collect like barnacles (why John Anderson among others was backing sunset legislation in 1978), that a mass of them do not require the scale which would justify federal action, and that a mess of them are dubious additions to the public sector’s store of activities to begin with. (A small but absolutely sterling example would be the patronage mill called the National Endowment for the Arts). He also does not care to acknowledge that the Democratic Party has long resorted to rank demagogy to frustrate efforts to put Social Security and Medicare on a more actuarially sound basis. He also would not care to acknowledge that federal employee compensation is opaque and excessive, that recruitment processes have been corrupted, or that the means of terminating an employee are hopelessly rococo.

Art Deco (ee8de5) — 7/21/2014 @ 9:17 ammake baseline budgeting extinct.

mg (31009b) — 7/21/2014 @ 9:19 ammg – Agree

daleyrocks (bf33e9) — 7/21/2014 @ 9:21 amWe all know how great deficit spending worked for the Romans, the Soviets and the Cold war eastern Europe, Weimar Germany, Britian and France after the world wars, Gualtieri Era Argentina, Zimbabwe.

How can you get call yourself an economist while ignoring reams of historical facts and fiscal data in your chosen field that totally contradict everything you say?

Canada in the early 1990s was in a similar predictment(if not on this scale). Governments of both right and left parties dealt with their deficit like adults.We have no adults in charge for a while. Austerity is not the end of the world, and what awaits us if we don’t put the brakes on will be much worse. Sadly since a brief period of fiscal sense during Clinton’s 2nd term both Bush and Obama have decided to max out the US Treasury’s credit. And Obama has hit the gas without a 2nd thought. If it’s “for our children” perhaps someone should consider they will be stuck with the bill.

Bugg (3a2abd) — 7/21/2014 @ 9:28 amI appreciate the in-depth analysis, I really do.

But the crux of our dilemma is that the middle class, the tax base, does not figure in anyone’s plans for redress.

Together the Dhimmis and the Wet Dreams are simply gaming two sides of the same cargo cult.

http://proteinwisdom.com/?p=54432

The so called voices of moderation, reason, pragmatism and incremental amelioration do not even talk about conceivable paths to restoration, you talk on and on about misdirections, asinine disputes over moral inconsequence immaterial to change.

gary gulrud (46ca75) — 7/21/2014 @ 9:28 amBut the crux of our dilemma is that the middle class, the tax base, does not figure in anyone’s plans for redress.

Not really. Our problem is that the political culture is such that no one wishes to make authoritative allocative decisions in the general interest, various parties will resort to gross demagogy if they do, and our political institutions are set up to frustrate any internally consistent course of action.

Art Deco (ee8de5) — 7/21/2014 @ 9:34 amSadly since a brief period of fiscal sense during Clinton’s 2nd term both Bush and Obama have decided to max

The federal deficit during fiscal year 2006-07 amounted to 1.2% of domestic product, not 9.2%. There’s irresponsible and then there’s irresponsible.

Art Deco (ee8de5) — 7/21/2014 @ 9:36 amIn fairness another imbecile in this regard is NRO’s Larry Kudlow, also in love with the percentage of GDP idea. Which makes sense really only if a. the GDP figures are accurate and b. you have a command and control top down corporatist government in bed with the kings of industry. As to a. the books have been cooked, deep-fried, barbequed, toasted, sauteed and left in boiling water for a very long time. And as to b. there are way to many people in both parties, on Wall Street and in DC who really want a corporatist crony capitalist oligarchy. The ruling class likes being on top. Stability uber alles.

Bugg (3a2abd) — 7/21/2014 @ 9:37 ammake baseline budgeting extinct.

The last effort to do that was during the Carter Administration. It might help, but your real problem is the patronage mill, the rent seeking, and sheer lack of imagination and guts.

Art Deco (ee8de5) — 7/21/2014 @ 9:37 amWhy is it that I’m getting a mental picture of the guy saying “Remain calm. All is well!” from the end of Animal House having Krugman’s face?

tweell (e3402e) — 7/21/2014 @ 9:39 amIn fairness another imbecile in this regard is NRO’s Larry Kudlow, also in love with the percentage of GDP idea. Which makes sense really only if a. the GDP figures are accurate

There’s nothing demonstrably wrong with national income accounting. You want to follow Mr. Shadowstats down his little rabbit hole, go ahead, but it’s a waste of time.

Art Deco (ee8de5) — 7/21/2014 @ 9:39 am“The federal deficit during fiscal year 2006-07 amounted to 1.2% of domestic product, not 9.2%. There’s irresponsible and then there’s irresponsible.”

You can dislike Clinton as a person and note that he was hemmed in by a GOP Congress. But you have to acknowledge that for a brief time during his 2nd term we were very close to closing the deficit. Which is not the same thing as paying down the debt.

Bugg (3a2abd) — 7/21/2014 @ 9:40 am8. “Not really.”

Normally one expects a point to follow disagreement.

gary gulrud (46ca75) — 7/21/2014 @ 9:45 amWe all know how great deficit spending worked for the Romans, the Soviets and the Cold war eastern Europe, Weimar Germany, Britian and France after the world wars, Gualtieri Era Argentina, Zimbabwe.

You’ve named an ancient empire which was suffering under the burden of secular demographic implosion, several other loci which functioned as command economies and suffered from chronically misallocated factors of production, three places that generated triple digit inflation by printing money, one place that defended an over-valued exchange rate for twenty years and damaged its industrial sector and a selection of service enterprises by reconstituting them as state enterprises (and state monopolies) addled by the ugliest trade unions in the occidental world, and one other place I cannot figure what you fancy the problem may have been.

Kind of a motley collection.

Art Deco (ee8de5) — 7/21/2014 @ 9:45 amNormally one expects a point to follow disagreement.

If you don’t care to read the point I’m making, that’s your business.

Art Deco (ee8de5) — 7/21/2014 @ 9:46 amStill, rising debt isn’t good.

why is that Mr. Krugman?

happyfeet (8ce051) — 7/21/2014 @ 9:48 am“The last effort to do that was during the Carter Administration. It might help, but your real problem is the patronage mill, the rent seeking, and sheer lack of imagination and guts.”

Art Deco – Part of the same problem. Getting rid of the BCA which mandates starting with the prior year’s funding and adding a COLA or inflation rider is the definition of stupid whether the spending was originally patronage based, some forgotten program that the only people who care about are the employees involved in it, or one which overlaps with a dozen others purportedly doing the same thing. Make each of them defend their existence and their freaking budgets and reform civil service rules.

daleyrocks (bf33e9) — 7/21/2014 @ 10:15 amWhat amazes me about Krugman is that he pretty much gets away with recycling the same column over and over. During the Bush years he yammered on and on about how a collapse was imminent thanks to the “irresponsible” Bush Tax Cuts — you know the ones that helped pull us out of the doldrums when the Dot Com Boom came crashing down. It’s true that the housing bubble (which Krugman was all for, by the way, since it ostensibly helped the middle class) eventually burst, but Krugman reminds one of the old joke about the economist who accurately predicts 7 out of the last 2 recessions.

So now, in the age of Obama Deficits, Krugman’s new tune on auto repeat is that massive deficits and rising debt aren’t anything to worry about. He was peddling that nonsense as far back as 2009 when he blithely told us that we could run trillion dollar deficits for several years without having any real impact on the long-term health of the economy. Leftists like Krugman always believe that we are working towards the blessed day when all of that spending will “pay off” and we will have massive increases in tax revenue because of all the make-work government-funded jobs and because all the targeted social spending magically ends up relieving all of our social ills so that we can empty the prisons and prune the welfare rolls.

More and more, Krugman is turning into the celebrated prize-winning economist who liberals feel they have to agree with in order to demonstrate their own intellect. But that emperor ain’t wearing any clothes, friends.

JVW (feb406) — 7/21/2014 @ 10:16 amIf you don’t know the difference between deficit and debt you just might be a liberal.

CrustyB (69f730) — 7/21/2014 @ 10:19 amWhat amazes me about Krugman is that he pretty much gets away with recycling the same column over and over.

Wagers his wife writes the column. He was occasionally abrasive but not politically partisand in his writing for general audiences prior to 2001. The things we do for nookie…

Art Deco (ee8de5) — 7/21/2014 @ 10:39 amAren’t we supposed to add “former Enron Adviser” whenever we use Krugman’s name?

daleyrocks (bf33e9) — 7/21/2014 @ 10:45 amI get about as much useful information on economics out of a Cracker-Jack’s box as I do from reading Krugman.

askeptic (efcf22) — 7/21/2014 @ 10:52 amJust to remind everyone of what should be obvious, but isn’t necessarily.

Every dollar of US federal debt held by the public is a financial asset (in the same amount) held by private individuals and institutions (outside of the amount held by foreign governments for forex purposes). There is a real market for the debt of the US federal government. In fact, its the deepest and most liquid market, bar none, in the world. There is real demand for that debt. In fact, there have been problems recently in the repo market because of a lack of availability of certain US treasury securities.

That’s not to say that our fiscal path is on a sustainable trajectory, however, i think that shouting from the rooftops that the sky is falling, when it isn’t makes you look like paranoid and delusional. That’s not to say that since the sky won’t fall for 50 years or so, doesn’t mean that we shouldn’t start addressing the issue now.

However, given that Japan has been well over 200% of GDP for quite some time now and the sky hasn’t fallen there should give credence that fiat currency debt is not like debt with hard collateral behind it and therefore we should address the issue a little more from a perspective of what the numbers are really telling us vs what we want to hear.

Regards

Jeffrey (2eddb6) — 7/21/2014 @ 11:17 amBasically, he just called you paranoid and delusional, but tried to put wiggle words around it

JD (e30991) — 7/21/2014 @ 11:26 amthe numbers are telling us the food stamp economy is not going to be able to meet its obligations to failmerica’s burgeoning smorgasbord of entitlement programs

happyfeet (8ce051) — 7/21/2014 @ 11:30 amwhat’s economic growth supposed to be this year?

1.5% at best?

losers.

happyfeet (8ce051) — 7/21/2014 @ 11:34 am“That’s not to say that our fiscal path is on a sustainable trajectory”

Jeff – The above is salient point along with the fact that there is no indication that there is any movement toward a sustainable trajectory.

daleyrocks (bf33e9) — 7/21/2014 @ 11:55 amfeets, just did a Google search and can’t seem to find any hard numbers for Q2.

askeptic (efcf22) — 7/21/2014 @ 12:26 pmQ4 last year (Q1 of FY-2014) was +2.6%, Q1 was -2.9%.

What I’m confused about: Is the -2.9 a number for the Quarter, or is that the ‘annualized’ projection for the trend?

If that’s the trend, that would seem to say that Q1 was actually a -5.5% (+/- depending on volume), and that to get back to a plus for the year, Q2 would have to have an actual growth of about +3%, which would be a real whip-saw – I would think that a lot of economists would be suffering whiplash.

Does anyone have any idea of where the economy stands today, 21 days into the last quarter of the Fiscal Year?

This country was at its greatest when the rich were taxed at 90%. California under democrats has come out of its financial problems when it started taxing the rich. Kansas under republicans went the other way and stopped taxing the rich and the state is in financial collapse! bill clinton taxed the rich(not enough) and we had budget surpluses. bush cut taxes for rich and we now have 18 trillion dollar deficit tax the rich feed the poor tax the rich till they ain’t rich no more!

vota (e06a52) — 7/21/2014 @ 12:29 pmWhat year(s) in particular do you look back on and think was the greatest, Vota?

elissa (50b92e) — 7/21/2014 @ 12:40 pmCan or has there ever been a Nobel prize awarded then later revoked?

EPWJ (775325) — 7/21/2014 @ 12:53 pmvota only knows what he reads in the DU and KosKids garbage.

askeptic (efcf22) — 7/21/2014 @ 1:02 pmHe/she/it has no actual knowledge of life beyond those confines.

It is sad, when you think about it, how people sacrificed (All sacrificed some, Some sacrificed all) so that this lump of protoplasm could sit on a log all day in complete security and comfort, and by entirely useless.

that’s an annualized number Mr. skeptic

second quarter consensus is at growth of 2.3% which leaves us in the hole for the first half of the calendar year

Positive Q3 would be great but then the polar vortex descends anew.

God help us.

happyfeet (8ce051) — 7/21/2014 @ 1:03 pmThanks feets, though I suspect those numbers will be revised several times before the calendar year is out.

askeptic (efcf22) — 7/21/2014 @ 1:05 pmIt is getting exceedingly difficult to trust anything that comes from the government any longer.

Your sense of history needs some work. The Bush tax rates were in effect in 2007. We were still conducting wars in Iraq and Afghanistan. And yet, the deficit then was a mere $117 billion, MUCH lower than any deficit Obama has presided over.

It wasn’t the tax cuts that created the deficit. In fact, we were getting around 18% of GDP in tax revenues throughout Bush’s terms. Under Obama, it’s been closer to 14-16% (while, at the same time, spending 20-25% of GDP). Why do you suppose it’s been so much lower under Obama?

Chuck Bartowski (11fb31) — 7/21/2014 @ 1:10 pm“… tax the rich feed the poor tax the rich till they ain’t rich no more!”

lead-based paints chips strike again… poor vota can’t even understand what Alvin Lee was trying to say.

Colonel Haiku (2601c0) — 7/21/2014 @ 1:16 pmbush cut taxes for rich and we now have 18 trillion dollar deficit

I wonder what the economy would have done after 9-11 if those tax cuts had not been in place. We would surely have avoided the crash of 2008, but not the way we would have wanted.

Kevin M (b357ee) — 7/21/2014 @ 1:17 pmpaul krugman tells lies

Colonel Haiku (2601c0) — 7/21/2014 @ 1:19 pmweasel words from ferret face

and the old soft shoe

Bush tax cuts

Here’s an example what Democrats call fairness:

In 1993, Clinton raised taxes solely on the to 20% of taxpayers, adding 36% and 39.6% brackets to the previous top rate of 31%, on incomes over $150K. This was “fair” (because it generally did not affect the people saying “fair”).

In 2001, Bush cut ALL brackets back, with the top bracket dropping to 35% (still higher than before 1993). Everyone who paid income taxes got a tax cut. Since it included the “rich” (aka “people who make more than I do”) and did not refund any money to people who paid no income taxes, it was “unfair”.

Kevin M (b357ee) — 7/21/2014 @ 1:25 pmoops. *top 10%*

Kevin M (b357ee) — 7/21/2014 @ 1:26 pmJFK’s Tax Cuts, One of the Greatest Policy Successes of All Time:

http://www.forbes.com/sites/briandomitrovic/2013/03/12/trashing-jfks-tax-cuts-one-of-the-greatest-policy-successes-of-all-time/

elissa (50b92e) — 7/21/2014 @ 1:33 pmYou can always tell a Democrat. Put your hand in your pocket, and if someone else’s hand is already in there – it’s a Democrat.

ropelight (0291de) — 7/21/2014 @ 1:33 pmI wonder what the economy would have done after 9-11 if those tax cuts had not been in place. We would surely have avoided the crash of 2008, but not the way we would have wanted.

I draw a blank. You’re saying that the tax cuts induced Freddie Mac to slash underwriting standards in 2003, induced the Financial Products Unit to write $400 bn worth of credit default swaps on mortgage pools the composition of which it was ignorant, induced Countrywide and Washington Mutual to go whole hog into subprime lending (IIRC, 46% of Countrywide’s loan portfolio eventually went sour)….

Art Deco (ee8de5) — 7/21/2014 @ 1:42 pmThe Financial Products Unit of AIG.

Art Deco (ee8de5) — 7/21/2014 @ 1:43 pmJust to point out elissa that growth rates in per capita income during the 1982-91 business cycle and the 1949-54 cycle were higher than they were during the 1960-70 cycle. Also, the salience of things like marginal rate cuts is going to vary depending on what the antecedent rates are. IIRC, the ultimate personal income tax bracket in 1965 was something on the order of 77%.

Art Deco (ee8de5) — 7/21/2014 @ 1:45 pmArt Deco–I was not paying personal income taxes in 1964 so I remember the Reagan cuts more vividly. I posted that Forbes piece for Vota. Democrats who still revere JFK and all the Kennedy’s, try to conveniently forget and never talk about this piece of JFK’s economic plan. There was a time when even some Democrats knew that lower taxes (one can argue he did not go low enough) is the way to kick start. It is hard to find a Democrat who will even say that publicly, let alone run on it today.

elissa (50b92e) — 7/21/2014 @ 2:01 pmThere was a time when even some Democrats knew that lower taxes (one can argue he did not go low enough) is the way to kick start. It is hard to find a Democrat who will even say that publicly, let alone run on it today.

I think the economist John Taylor would tell you that only presumptively permanent income tax cuts have salutary effects of the sort to which you are referring.

Sorry to be repetitive on this point, but the political class was facing in 1962 a different situation than they are today. IIRC, from 1932 to 1981, ultimate marginal rates always exceeded 60%. When queried a few years ago, Bradford deLong offered the view (from bibliography, presumably) that rates turn self-defeating and toxic at around 70%. For the most part, ultimate marginal rates did exceed 70% during that fifty year interval, even after the 1964 cuts.

When you’re talking about marginal rates which top off at 39% at the federal level and a mean of 6.6% at the state level, reductions in marginal rates are going to be of less consequence as policy measures, all else being equal.

Art Deco (ee8de5) — 7/21/2014 @ 2:26 pmI posted that Forbes piece for Vota.

I think Vota’s native language is Pidgin Spanish. I doubt he’ll be able to make much sense of it.

Art Deco (ee8de5) — 7/21/2014 @ 2:28 pmYes, but you can’t tell him much.

Chuck Bartowski (11fb31) — 7/21/2014 @ 2:31 pmArt Deco – What Reagan’s tax reforms did along with lowering marginal rates though, was to eliminate many common itemized deductions and devices widely used to reduce taxable income by people who found their incomes creeping into higher brackets when all those layers were in place. Tax shelter promoters suddenly had to find new ideas to peddle.

daleyrocks (bf33e9) — 7/21/2014 @ 3:00 pmArt Deco (ee8de5) — 7/21/2014 @ 9:17 am

Servicing costs are currently depressed due to the situation with interest rates. Would not count of that continuing.

Paul Krugamn in fact is, or he says the Congressional Budget Office is:

Krugman:

Now I don’t think the CBO is any good at predicting interest rastes, or the last word.

If Krugman were honest he would say, interest rates will remain low so long as President doesn’t make the wrong appointments to the Federal Reserve Board. This should be his strongest point against Republicans. That is, most Republicans adhere to the kind of economic thinking that will cause interest rates to go up and get into a debt spiral. It’s not inevitable that interest rates will stay low. That depends on who is elected to federal office.

Also, Krugman does not note that the reason the debt to G.D.P. ratio declined was inflation.

frustrate efforts to put Social Security and Medicare on a more actuarially sound basis.

The problem is it was put on a more actuarially sound basis – but Social Security can’t truly save money.

Its soundness depends enormously on the projected real rate of growth of G.D.P. The rates being used actually are historically low, so it sis really much more sound that projected.

Also, population is an important factor, and the Republican Party seems to have a policy of trying to keep the populaton of the United States down.

Sammy Finkelman (51afd4) — 7/21/2014 @ 3:05 pmArt Deco (ee8de5) — 7/21/2014 @ 1:45 pm

IIRC, the ultimate personal income tax bracket in 1965 was something on the order of 77%.

I think at one point there was maximum 50% rate for earned income (salry) but a 7)% rate for unearned income that was not long term capital gains.

Sammy Finkelman (51afd4) — 7/21/2014 @ 3:07 pmIf Krugman were to say that interest rates depend on who gets elected, he would also be saying the current high level of debt is a danger, because the wrong people, or people who would choose to listen to the wrong economists, could always get elected, especially, as he says, so many people are wedded to bad economic theory.

The fiscal panic has fizzled – but it could come back again. The projections vary enormously over a period of a several years. Ronald Reagan actually proposed * that the U.S. stop making 10-year budget projections because you just simply can’t fdo that accurately. (Reagan wanted to limit it to 5-years)

* After David Stockman “explained” his publoished comments by saying projections aren’t accuarte, which is true,

Sammy Finkelman (51afd4) — 7/21/2014 @ 3:12 pmIts soundness depends enormously on the projected real rate of growth of G.D.P. The rates being used actually are historically low, so it sis really much more sound that projected.

The soundness of income transfer programs and collective purchasing schemes depends on their being structured so that they do not induce an escalating consumption of available resources. In the case of Social Security, having the retirement age on a cohort-to-cohort escalator will suffice to maintain a stable ratio of beneficiaries to workers over time. With regard to Medicare, that would help. What would also help is allocating a fixed share of earned income to Medicare expenditures, excising the fees beneficiaries pay, and adding deductibles each year if costs outrun revenues. You could also remove outside income limits which attend to Social Security beneficiaries, so that the elderly could make some adjustments to pay any deductibles.

Currently, retirement ages are on a glacial escalator.

Art Deco (ee8de5) — 7/21/2014 @ 3:36 pmI draw a blank. You’re saying that the tax cuts induced Freddie Mac to slash underwriting standards in 2003

You clearly miss my point, which is that we would have entered a deep recession in 2001 instead of later if we weren’t set up with those tax cuts, and the rest of it would not have happened the same way. Go back and read what I wrote.

Kevin M (b357ee) — 7/21/2014 @ 3:43 pmKrugman said he got just one thing wrong during the Bush administration. Just one thing. The only problem is that one thing allowed him to call a mulligan on 7 years of columns. Krugman is more buffoon then economist.

East Bay Jay (a5dac7) — 7/21/2014 @ 3:46 pmYou clearly miss my point, which is that we would have entered a deep recession in 2001 instead of later if we weren’t set up with those tax cuts,

Come again? The Bush cuts did not go into effect until October 2001. As it was, there were alternating quarters of growth and contraction in 2001, neither at high rates. Re production, it was a not a true recession. I would guess that the NBER labeled it a recession because the labor market was deteriorating (and continued to do so for about a year and a half after the economy resumed sustained growth in late 2001). It may have been that the economy would have grown more slowly after 2001, but a ‘deep recession’ is a difficult counter-factual to credit.

Art Deco (ee8de5) — 7/21/2014 @ 3:51 pmAlso, the Bush cuts were structured to be ‘temporary’. Re John Taylor, those sorts of cuts do not have more than short term effects and do not influence investment.

Art Deco (ee8de5) — 7/21/2014 @ 3:53 pmKrugman said he got just one thing wrong during the Bush administration. Just one thing. The only problem is that one thing allowed him to call a mulligan on 7 years of columns. Krugman is more buffoon then economist.

Daniel Okrent was for some years the ombudsman at the Times during a part of Krugman’s tenure. One aspect of his job was to importune reporters to print corrections. He offered retrospectively that he found corresponding with Krugman a root canal in executing this task. He said Krugman was very resistant to acknowledging anything.

Art Deco (ee8de5) — 7/21/2014 @ 3:55 pmWhat Reagan’s tax reforms did along with lowering marginal rates though, was to eliminate many common itemized deductions and devices widely used to reduce taxable income by people who found their incomes creeping into higher brackets when all those layers were in place. Tax shelter promoters suddenly had to find new ideas to peddle.

You’re confounding the 1986 legislation (which Reagan’s Treasury had drawn up inspired by proposals flogged by Bill Bradley) with the 1981 legislation, which cut marginal rates, added indexing, and which had a mess of garlic hung on it by Congressional rent-seeker advocates. A mess of good done with the imperfect 1986 legislation was undone with Bilge Clinton’s ‘targeted tax cuts’. The Democratic Party lives to manufacture patron-client relationships, so their affection for tax breaks is unsurprising. The Chamber-of-Commerce lickspittle wing of the Republican caucus ditto. The aldamatoesque my-district-uber-alles wing also.

For my own part, I’d like the Republican caucus to make a point to eliminate tax preferences for favored economic sectors and to re-define capital gains to mean real rather than nominal gains (but otherwise treat it like ordinary income). They seem to be bound and determined to obsess over marginal rates and such to the exclusion of other considerations.

Art Deco (ee8de5) — 7/21/2014 @ 4:04 pmAnd if they had not been passed in June 2001, they would not have gone into effect until the middle of 2002, the market crash would have continued (instead of rebounding for a bit) and the weak recovery from the 2000 recession would have evaporated. As it was the DOW was still WELL off its 2000 peak until mid 2003.

Kevin M (b357ee) — 7/21/2014 @ 4:06 pmKevin, there was no 2001 recession in ordinary terms, tax cuts or no tax cuts. The declines and increases in production levels measured month-to-month about balanced each other out. The market crashed in 2000-01 because it was horribly over valued. Pigou effects from declines in asset prices are not that important and are a weak vector in generating recessions.

Art Deco (ee8de5) — 7/21/2014 @ 4:16 pmSo, ArtDeco, are you saying that if John Taylor’s policy prescriptions had been followed, they country would be better off, and the economy would have progressed in a different manner than it did over the last 20-years?

askeptic (efcf22) — 7/21/2014 @ 4:19 pmYou do realize that Taylor was a member of the President’s Council of Economic Advisors under Bush-41, and was an Under-Secretary of the Treasury under Bush-43, and that …”Federal Reserve Chairman Ben Bernanke has said that Taylor’s “influence on monetary theory and policy has been profound,”[12] and Federal Reserve Vice Chair Janet Yellen has noted that Taylor’s work “has affected the way policymakers and economists analyze the economy and approach monetary policy.”[13]…”

(Wikipedia: John B. Taylor)

Also, when those marginal rates were so high (60%+), those affected by them were able to avail themselves of many more deductions and tax-delaying schemes than are those same income-group taxpayers today.

“You’re confounding the 1986 legislation (which Reagan’s Treasury had drawn up inspired by proposals flogged by Bill Bradley) with the 1981 legislation”

Art Deco – No, I’m not. The 1986 Act added to what was done in 1981 by collapsing 15 brackets down to 4 and dropping the highest bracket from 50% down to 28% (with a 33% bubble bracket), limiting passive income and loss abuses common at the time and a host of other stuff.

daleyrocks (bf33e9) — 7/21/2014 @ 4:20 pmAnd there was a fairly significant contraction of the economy in Q4 of 2001 – something about a ‘man caused disaster’ in NYC.

askeptic (efcf22) — 7/21/2014 @ 4:28 pmSo, ArtDeco, are you saying that if John Taylor’s policy prescriptions had been followed, they country would be better off, and the economy would have progressed in a different manner than it did over the last 20-years?

No, I’m reporting what John Taylor had to say. Sometimes a cigar is just a cigar.

I’m not sure what significance you attach to his employment history re this discussion.

Art Deco (ee8de5) — 7/21/2014 @ 5:13 pmArt Deco – Does Taylor’s definition of temporary extend to 10 years, the duration of the Bush ’43 tax cuts, because that is certainly long enough in my experience to affect behavior.

daleyrocks (bf33e9) — 7/21/2014 @ 5:18 pmNo, I’m not. The 1986 Act added to what was done in 1981 by collapsing 15 brackets down to 4 and dropping the highest bracket from 50% down to 28% (with a 33% bubble bracket), limiting passive income and loss abuses common at the time and a host of other stuff.

The 1981 act was derived from model legislation which had been flogged for years in Congress by William Roth and Jack Kemp (and by the WSJ editorial page outside of Congress). The point was to cut marginal rates. Indexing (favored by George Bush the Elder in 1980) was added. Cutting special deductions and exemptions was not an object (it turned into a dog’s breakfast in this regard).

The 1986 Act added to what was done in 1981

The original intent that the Treasury had was to eliminate deductions and exemptions and lower marginal rates, maintaining revenue neutrality. Tax simplification was the primary goal and the reduction in marginal rates was a function of that.

Art Deco (ee8de5) — 7/21/2014 @ 5:19 pmArt Deco – Does Taylor’s definition of temporary extend to 10 years.

IIRC, no, because the expiration of the rate cut was baked in the cake.

Art Deco (ee8de5) — 7/21/2014 @ 5:21 pmArt Deco– re:”the discussion” –After reading several of the back and forths you’ve had with various commenters I find I’m not sure anymore the main point you are trying to make, or conversely what main point you might be trying to refute with respect to Patterico’s thread topic. Obviously this topic interests you and a lot of other people. Can you back up and just do a simple bullet point or two on what your issue/point is?

elissa (50b92e) — 7/21/2014 @ 5:25 pmAnd there was a fairly significant contraction of the economy in Q4 of 2001 – something about a ‘man caused disaster’ in NYC.

During the period running from 2000 q2 to 2003 q3, the (quarter-to-quarter) change in the (annualized) rate at which goods and services were being produced varied from -1.2% to 7.8%. The two quarters in which contractions were registered were 2001 q1 and 2001 q3. The real economy grew at a 1.0% rate in q4. The net for 2001 q1-4 was +0.76%

Art Deco (ee8de5) — 7/21/2014 @ 5:32 pmAfter reading several of the back and forths you’ve had with various commenters I find I’m not sure anymore the main point you are trying to make

Usually, I’m just responding to a point the other person has made. My view of fiscal policy is stated in my very first post (3d in this thread). No deep inner meaning in anything I say.

Art Deco (ee8de5) — 7/21/2014 @ 5:36 pmArt Deco, to me, personifies why Harry Truman was always searching for one-armed Economists – because every point they make seems to be followed with an ‘on the other hand’.

askeptic (efcf22) — 7/21/2014 @ 5:42 pm“The original intent that the Treasury had was to eliminate deductions and exemptions and lower marginal rates, maintaining revenue neutrality. Tax simplification was the primary goal and the reduction in marginal rates was a function of that.”

Art Deco – I agree with the description of the intent, but the impact on individuals was very disparate.

daleyrocks (bf33e9) — 7/21/2014 @ 5:42 pmArt-

There are some “great minds” like Krugman, Kudlow and our last 2 presidents who assume the United States government can keep borrowing money…because…it’s the United States government.There is no ecomomic reason to pretend historical precedents do not apply. And we are toa degree unique; we borrow from China to keep a huge military in the field to combat ..China’s agression? It’s being too big to fail on an unprecedented scale. The interest is already putting a serious crimp in our budget and economy. It takes only am auction of federal debt where the usual suspects like China, the Saudis, Japan and Germany either demand a higher interest in order to invest(very bad) or decide not to show up at all(way worse). Every calculation assumes the debt payout to investors is very low. When that changes, should the US become PIIG like, or even iffy, watch out. Because then all the rosy happytalk about percentage of GDP and low interest rates becomes a sweet song never to be heard again in the ensuing chaos.

Bugg (f0dbc7) — 7/21/2014 @ 5:46 pmAs to the wonders of Bush tax cuts, with AMT, very few working class people saw them.There’s no point to a tax cut on one line of your 1040 if that surcharge afew lines down wipes it out. Neither party wants to get rid of AMT because the money is too huge. It’s never been indexed for inflation and the supposed fixes have been a joke.

Bugg (f0dbc7) — 7/21/2014 @ 5:49 pmOur military is not contextually all that large at this time. IIRC, military spending average 6.7% of gdp per annum during the Cold War. Now it’s down to about 4.5%. The population’s aging and the determination of benefit levels appended to Social Security and Medicare do not take much account of that. The market for medical care is hopelessly bollixed on suffers secular real cost inflation. The Democratic Party has all kinds of hinky things it wants to do with public money, like Steven Chu’s Department of Energy venture capital fund, fat subventions to grocery purchases and rental housing and people’s utility bills, the higher education patronage mill, the agribusiness patronage mill, the whole nine yards.

Art Deco (ee8de5) — 7/21/2014 @ 5:53 pmBugg (f0dbc7) — 7/21/2014 @ 5:49 pm

Actually, the tax revision proposed by Chmn. Camp of Ways & Means does away with the AMT, which probably means that it will never pass.

askeptic (efcf22) — 7/21/2014 @ 6:19 pmYou keep saying bush tax cuts were needed for 9-11. If republicans on supreme court had not stolen the 2000 election for bush we would not have had 9-11 because president Al Gore didn’t need a second pearl harbor to invade iraq as neocon artists in bush administration did. And most of these chicken hawks were vietnam war draft dodger cowards!

vota (e06a52) — 7/21/2014 @ 6:36 pmtake him away!

elissa (50b92e) — 7/21/2014 @ 6:42 pmWhat a fucking idiot!

askeptic (efcf22) — 7/21/2014 @ 6:42 pmMolitsas, you really should go to AZ.

17. I’m sorry, but your ‘point’ in 8. mandates mind reading, not actual evidence like a significant proposal, e.g., to abolish the IRS with a flat tax of some flavor.

My point about your lack stands.

gary gulrud (46ca75) — 7/21/2014 @ 7:18 pm79. The education industry has risen at twice the rate of the health industry since the 1970’s when the Feds got into student financing.

No one has mooted a fix even tho a $1 Trillion overhang will wreck Amerikkka if Obamaneycare doesn’t first.

Misdirection once again.

gary gulrud (46ca75) — 7/21/2014 @ 7:26 pm85. Insty on student loan debt:

http://pjmedia.com/instapundit/192090/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+pjmedia%2Finstapundit+%28Instapundit%29

So lets just forgive them all, eh?

gary gulrud (46ca75) — 7/21/2014 @ 8:29 pmGG-

More proof as with the the NYC housing thread that every time the government puts it’s fingers on the scales of supply and demand it totally effs it up. The path to Hell is paved with good intentions and there is no political constituency for the word NO.

Bugg (f0dbc7) — 7/22/2014 @ 5:17 am87. Word, moreover incremental improvement is a mirage. Voting is a comprehensive failure.

gary gulrud (46ca75) — 7/22/2014 @ 5:44 amIt’s true enough that we had a huge debt after World War II, but, at the end of FY1946, we owed 99% of our national debt to Americans. That meant that, as we serviced that debt, we were putting that money right back into the American economy. Today, we owe a substantial chunk of the debt to foreign governments, institutions, banks and individuals, which means that a substantial part of our debt service leaves our leaves our economy.

But the main problem is that we have been behaving like half-Keynesians. Keynesian economics holds that governments should run deficits during bad times, to stimulate the economy, but also that they should balance their budgets and pay down that debt during good economic times; that part we never seem to have gotten around to doing. We have been, in effect, importing the GDP of other countries to spend more than we produce, and have been dong it for so long that it has become the (not so) new normal. Added stimulus doesn’t help as much as it should, because we have been stimulating the economy all along.

The Dana who does not have a Nobel Prize in Economics, but still has more sense tham Paul Krugman (f6a568) — 7/22/2014 @ 7:15 am@18

Former Enron advisor Paul Krugman wants to be able to turn back around and howl that an R Preezy is making the debt worse than it needed to be. See, it’s manageable right now, no big deal. But when the leadership changes…. gotta cover all rhetorical bases and all.

Joseph D (f8f518) — 7/22/2014 @ 9:04 amno matter how high you raise that top rate, you never get federal revenue much above 20% of GDP.

There may be only so much that can be gotten by “soaking the rich”, but many countries have much higher ratios of tax revenue to GDP.

Britain, for instance: 41.1%. Denmark, 55.9%; Japan, 34.7%; Israel, 40.2%; Canada, 37.7%. (The U.S. ranks 182nd with 17.0%.)

VAT and payroll taxes are the main implements for this.

Rich Rostrom (f02406) — 7/22/2014 @ 5:46 pmStockman on Krugman:

http://www.zerohedge.com/news/2014-07-22/krugman%E2%80%99s-latest-debt-denial-why-his-two-magic-numbers-don%E2%80%99t-cut-it

91. Be that as it may–and its been as high as 24% during antiChrist’s tenure–until recently Amerikkka enjoyed impunity unique in this world’s economy, funding her dissipation. Since 2009 10% of GDP is Federal Reserve wet green ink.

While China, Japan and Russia are no longer purchasing US debt, whereas the ECB has surged buying $350 Billion in 6 mo. The former nations have nonetheless piled out of long-term debt into very short term as the yields have inverted.

The Federal government, while reducing its deficit is piling ever more unfunded mandates on the States. And finally, revenues are running a little north of 60% of expenditures.

The Fed’s intended mechanism(reverse repurchase agreements) of dumping its own debt purchases, now about $4.5 Trillion has recently been panned as fruitless by none other than JPMorgan.

We are cornered will fall on our sword.

gary gulrud (46ca75) — 7/22/2014 @ 9:02 pm